Share This Article

An unprecedented channel of systemic risk is emerging between Japanese Government Bonds (JGBs) and cryptocurrencies. The rapid normalization of JGB rates leads to a sharp appreciation of the Yen (JPY), triggering a global « Margin Call. » This situation is aggravated by the collapse of the JPY carry trade, the flight of liquidity from Japanese platforms, and the reduction in the supply of stablecoins (USDT), creating an asymmetric liquidity crisis. Our quantitative analyses predict that a disorderly unwinding could push Bitcoin’s Beta relative to USD/JPY to -3.5x, meaning a 25% to 40% drop for BTC for only a 10% appreciation of the Yen.

1. MECHANISM 1: THE EXPLOSION OF THE « JAPAN CARRY TRADE » AND THE EFFECT OF LEVERAGE

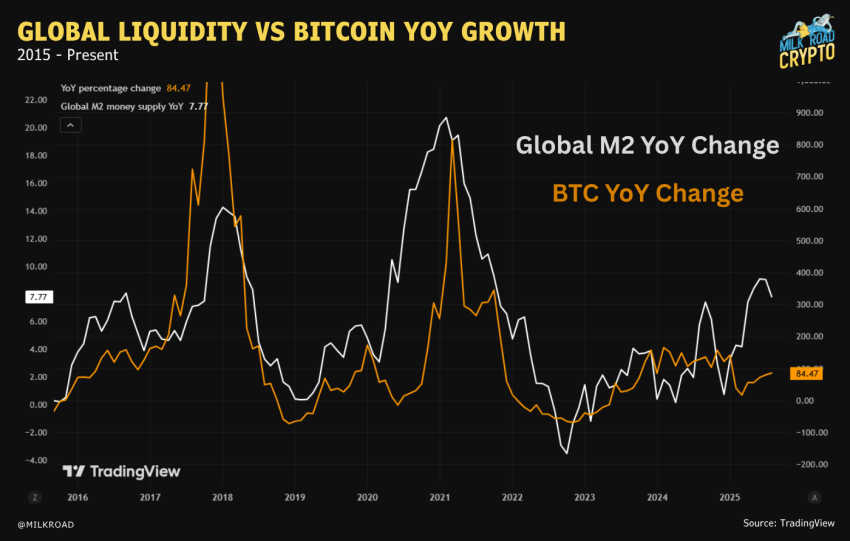

The crypto-asset market has greatly benefited from the accommodative monetary policy of the Bank of Japan (BoJ), making the Yen (JPY) a universal « Funding Currency, » particularly for the « Japan Carry Trade. » The initial mechanism involved borrowing in JPY at very low rates (0-0.5%) to purchase higher-yielding assets like BTC or ETH after converting to USD. However, an interest rate shock, such as a significant appreciation of the JPY (e.g., from 150 to 135 USD/JPY), mechanically increases the cost of repaying the debt in the funding currency.

This changes the Carry Trade equation: if the return on BTC falls below the total cost (funding and exchange rate loss), liquidation becomes mandatory. Technically, this results in a widening of the Cross-Currency Basis, as the cost of hedging the exchange rate becomes prohibitive. The majority of BTC positions funded in JPY are leveraged (via perpetual contracts or DeFi). A JPY appreciation rapidly erodes investors’ capital. To maintain required margin ratios, platforms’ risk management algorithms trigger automatic liquidations (« Auto-Deleveraging« ). These forced sales on the market cause immediate downward pressure on the price of Bitcoin, regardless of the digital asset’s own fundamentals.

2. MECHANISM 2: LIQUIDITY OUTFLOW FROM JAPANESE EXCHANGES

Mechanism 2 analyzes liquidity outflows from Japanese exchanges as a leading indicator. Wealthy Japanese investors (« Digital Mrs. Watanabes« ) are withdrawing funds from platforms like bitFlyer, GMO Coin, and Coincheck. This movement is often linked to valuation arbitrage between onshore and offshore markets. When the Japanese Yen (JPY) appreciates, the JPY value of Bitcoin (quoted in USD) decreases. Facing a double loss (from exchange rate and asset price), these investors repatriate their capital. This JPY exodus reduces the order book depth on local exchanges. Reduced liquidity increases slippage and amplifies volatility, causing price declines to worsen during large sell-offs.

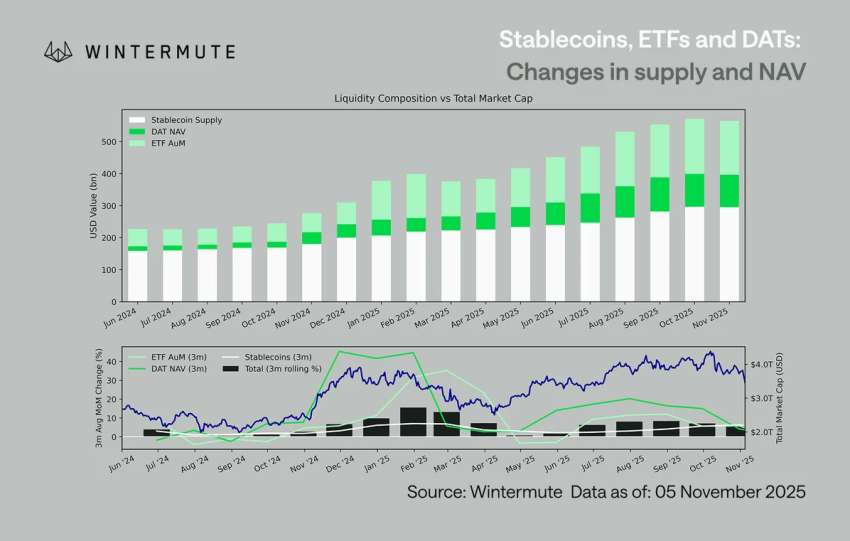

3. MECHANISM 3: THE STABLECOIN CONTRACTION AND THE LIQUIDITY WALL

The interaction between fiat and crypto markets relies on stablecoins (USDT, USDC) as liquidity bridges. Analysis of USDT shows a structural vulnerability in the event of systemic stress. Stablecoins function as the internal reserve currency of the crypto system, with their supply linked to confidence in the fiat banking system that backs them. If a JPY appreciation signals systemic banking risk (affecting Japanese banks holding JGBs), global investors may become wary of the banking partners of stablecoin issuers. This triggers a balance sheet mismatch where investors redeem their USDT for USD/JPY from the issuer (Tether). Tether must then liquidate its assets (US Treasuries, Repo) through its banking partners, leading to a decrease in the circulating supply of USDT. This contraction of the digital currency supply, just as the market seeks to deleverage, amplifies volatility, equivalent to removing the shock absorbers from a vehicle in turmoil. Less USDT means a reduced capacity for « Dip Buying » and less collateral in DeFi protocols (Aave, Compound), which can trigger cascading liquidations of crypto loans.

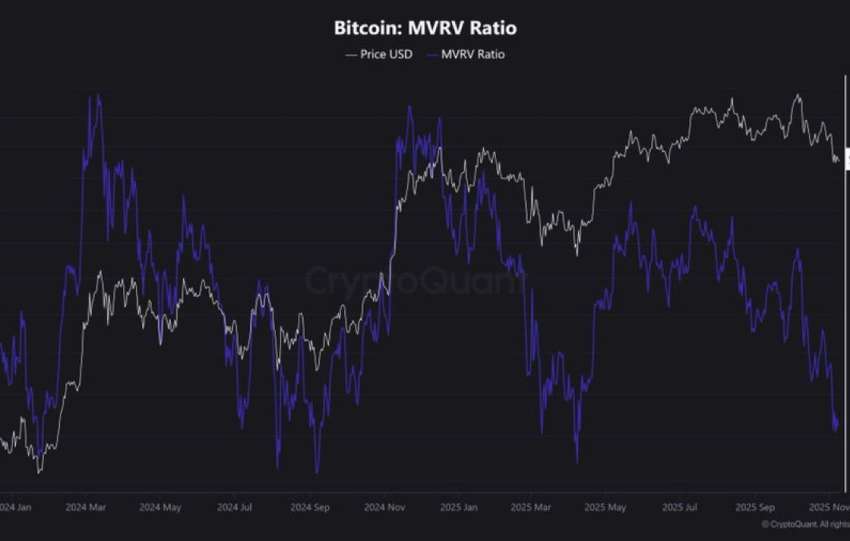

4. QUANTITATIVE MODELING: THE BETA -3.5X

To validate the hypothesis of a 25% to 40% drop in Bitcoin (BTC), our analysis uses Steelldy’s « Risk Factor Attribution » module, incorporating tail dependence. The calculation of the dynamic Beta is based on the regression: Δln(BTCt)=α+β⋅Δln(USD/JPYt)+ϵt

Normally, β≈−0.5. During periods of stress (JGB crisis), the correlation reverses and strengthens (Flight to Safety / Risk Off). Price shock decomposition (example: +10% JPY / -9.1% USD/JPY): the direct exchange rate effect contributes to a -9% drop, leverage (-15% to -20%), liquidity loss (-5% to -10%), and sentimental panic (-1% to -5%) lead to a projected total of -30% to -44%. A Beta of -3.5x is a conservative worst-case estimate, corresponding to the 99th percentile of the risk distribution.