Share This Article

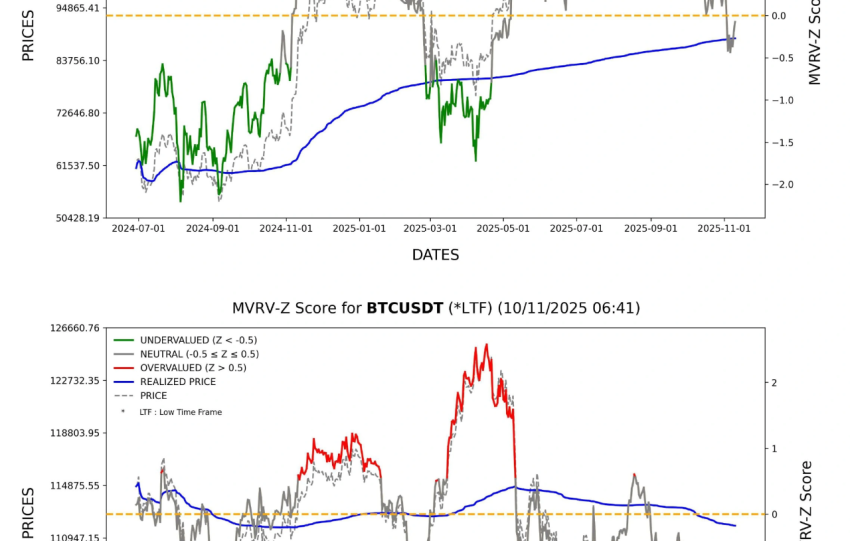

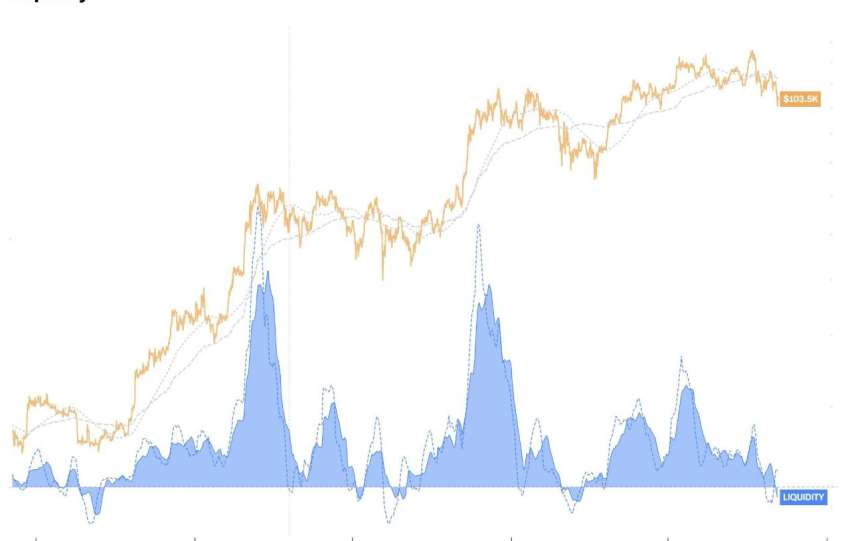

An unprecedented channel of systemic risk is emerging between Japanese Government Bonds (JGBs) and cryptocurrencies. The rapid normalization of JGB rates leads to a sharp appreciation of the Yen (JPY), triggering a global « Margin Call. » This situation is aggravated by the collapse of the JPY carry trade, the flight of liquidity from Japanese platforms, and the reduction in the supply of stablecoins (USDT), creating an asymmetric liquidity crisis. Our quantitative analyses predict that a disorderly unwinding could push Bitcoin’s Beta relative to USD/JPY to -3.5x, meaning a 25% to 40% drop for BTC for only a 10% appreciation of the Yen.

1. MECHANISM 1: THE EXPLOSION OF THE « JAPAN CARRY TRADE » AND THE EFFECT OF LEVERAGE

The crypto-asset market has greatly benefited from the accommodative monetary policy of the Bank of Japan (BoJ), making the Yen (JPY) a universal « Funding Currency, » particularly for the « Japan Carry Trade. » The initial mechanism involved borrowing in JPY at very low rates (0-0.5%) to purchase higher-yielding assets like BTC or ETH after converting to USD. However, an interest rate shock, such as a significant appreciation of the JPY (e.g., from 150 to 135 USD/JPY), mechanically increases the cost of repaying the debt in the funding currency.

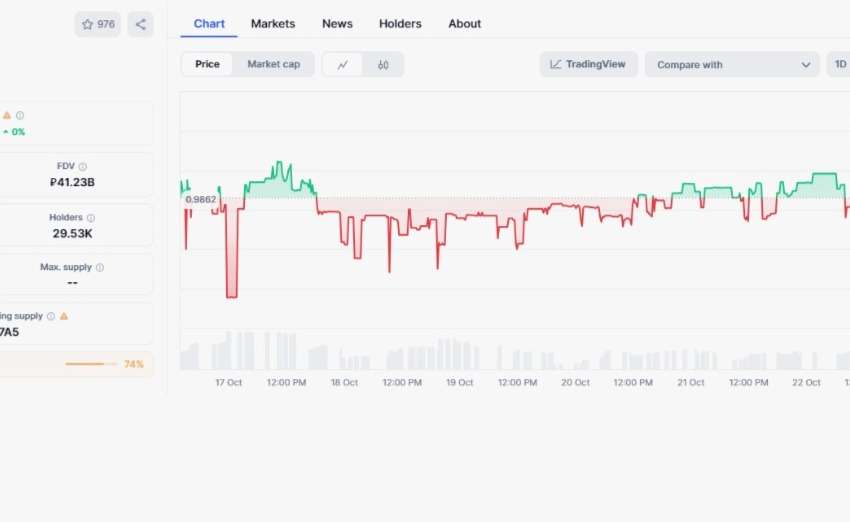

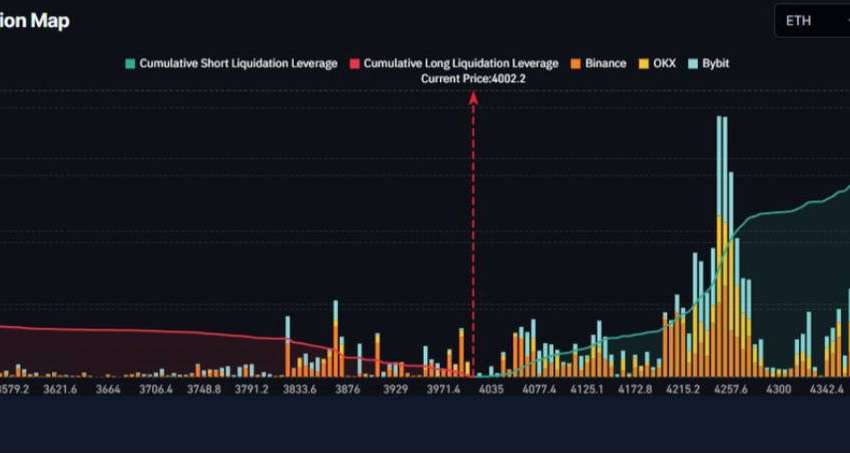

This changes the Carry Trade equation: if the return on BTC falls below the total cost (funding and exchange rate loss), liquidation becomes mandatory. Technically, this results in a widening of the Cross-Currency Basis, as the cost of hedging the exchange rate becomes prohibitive. The majority of BTC positions funded in JPY are leveraged (via perpetual contracts or DeFi). A JPY appreciation rapidly erodes investors’ capital. To maintain required margin ratios, platforms’ risk management algorithms trigger automatic liquidations (« Auto-Deleveraging« ). These forced sales on the market cause immediate downward pressure on the price of Bitcoin, regardless of the digital asset’s own fundamentals.