Share This Article

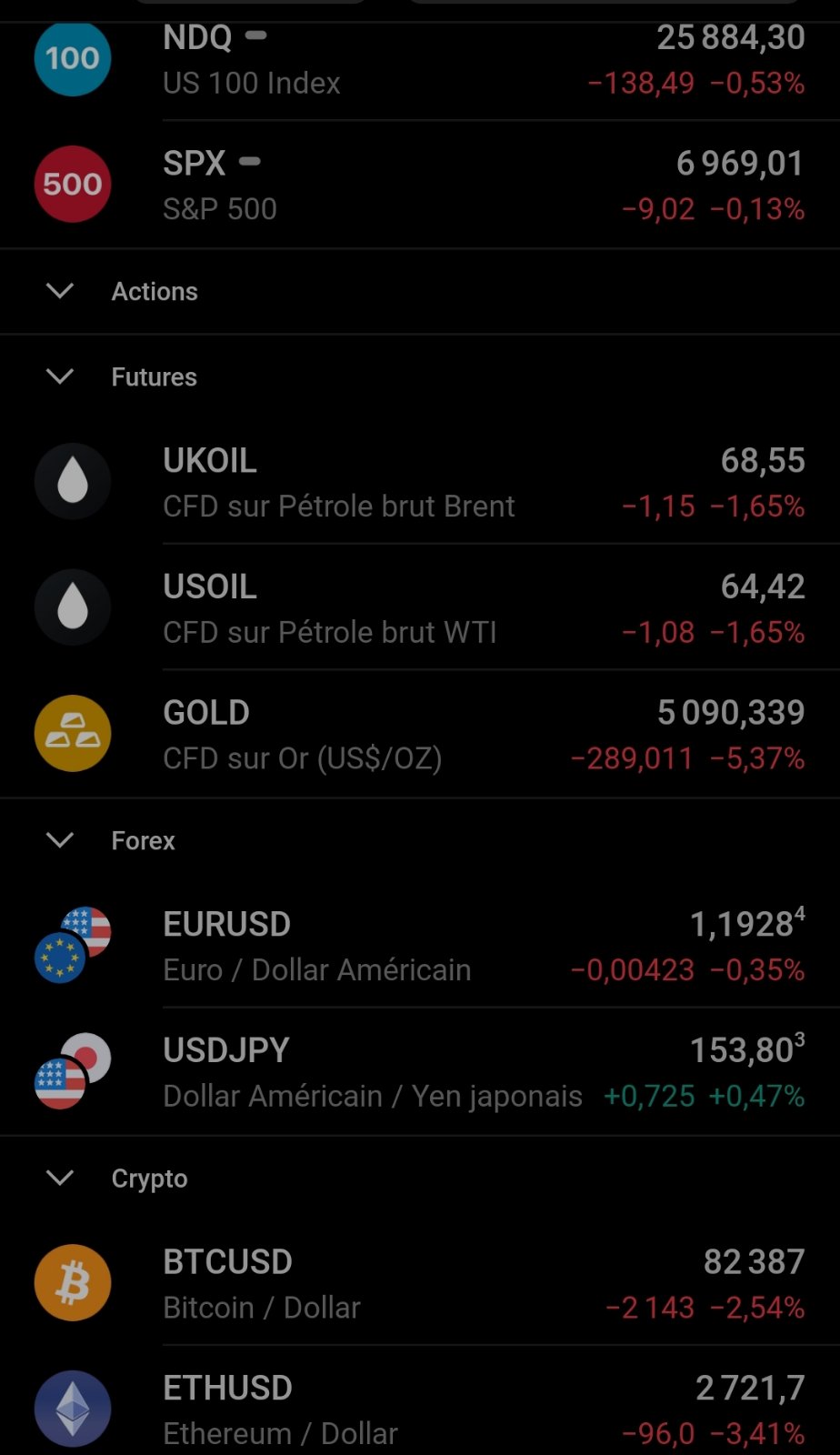

For the first time since March 2020, an unprecedented synchronized sell-off is affecting all asset classes (equities, energies, precious metals, currencies, cryptos), indicating systemic liquidity stress and an abnormal correlation of 1.0. Our system (Steelldy) has detected structural changes in correlations, notably the Gold/SPX correlation moving from -0.35 to +0.82 (panic signal) and the Oil/Tech correlation moving from -0.15 to +0.75 (recession signal). The inversion of the USDJPY/VIX correlation to -0.65 signals the unwinding of the carry trade. This situation is not a simple correction but the simultaneous activation of four negative feedback loops: the unwinding of the Yen carry trade, debt-driven deflation leading to a compression of risky assets, global liquidity contraction due to central bank balance sheet tightening, and the realization of recession risk where gold loses its safe-haven role.

1. Anatomy of the correlation at 1.0

Our study compares theoretical models of asset correlations (Risk-Off, Inflation, Deflation) with a current state based on a 5×5 matrix of SPX, Brent, Gold, USDJPY, BTC. The theoretical regimes describe opposite movements depending on the economic context. The current matrix shows mostly positive correlations, except with USDJPY (negative). The interpretation suggests that all assets are declining except for the appreciating JPY, indicating forced global deleveraging.

Current status detected (5×5 Correlation Matrix):

| Asset | SPX | Brent | Gold | USDJPY | BTC |

|---|---|---|---|---|---|

| SPX | 1.00 | +0.75 | +0.82 | -0.60 | +0.68 |

| Brent | +0.75 | 1.00 | +0.71 | -0.55 | +0.65 |

| Gold | +0.82 | +0.71 | 1.00 | -0.70 | +0.73 |

| USDJPY | -0.60 | -0.55 | -0.70 | 1.00 | -0.62 |

| BTC | +0.68 | +0.65 | +0.73 | -0.62 | 1.00 |

Interpretation: All assets are moving down together except for the JPY which is appreciating. This is the signature of a forced global deleveraging.

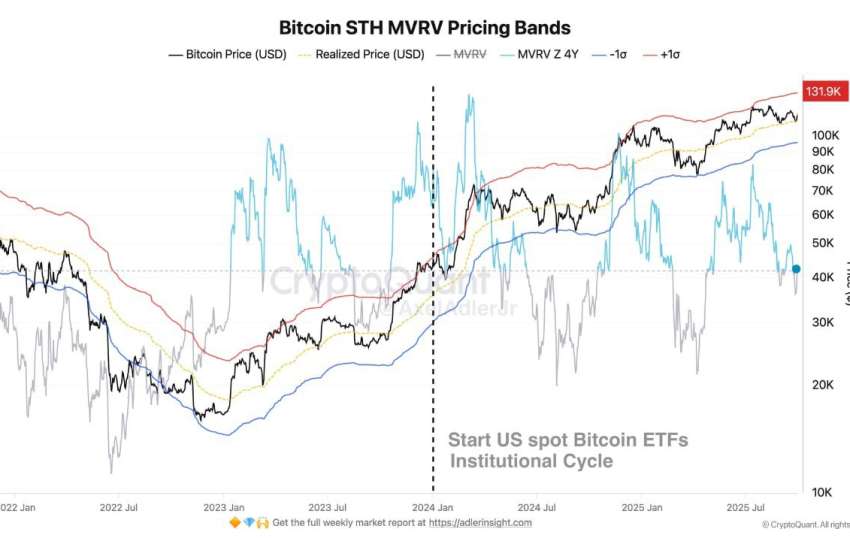

The Gold Shock -5.37%: The Decisive Indicator

The -5.37% drop in gold represents an exceptional move, ranking in the 99th percentile of daily variations over the last 20 years. This fall caused a break below a key technical support level, the 200-day moving average, at the $5,100 level. Furthermore, the Gold/SPX ratio fell below 0.73, its lowest level since November 2023. Several factors explain this correction. The most likely scenario (60%) is forced selling due to margin calls on other assets, probably equities. This is supported by gold volume three times higher than normal, concentrated during Asian hours, suggesting that funds are liquidating gold to cover their funding calls. A lower probability (25%) is linked to the evolution of the inflation narrative. The recent announcement of a Core PCE reading of 1.8% (below the Fed’s target) is leading the market to anticipate disinflation or deflation, thereby diminishing gold’s appeal as an inflationary hedge. Finally, a coordinated central bank intervention (15%) to defend currencies or finance other operations is a possibility, although less supported by direct indicators. The diagnosis therefore points strongly towards a liquidity issue and forced portfolio rebalancing, with a secondary influence due to the changing inflation outlook.

2. The four negative feedback loops

2.1 Loop °1: Unwinding the Yen Carry Trade

The Yen carry trade (USDJPY at 153.80) is profitable but exposed to major foreign exchange risk. Fear of an intervention by the BoJ/MOF at the 155.00 USDJPY threshold forces an early exit from JPY short positions, leading to its appreciation. This triggers a forced deleveraging of positions funded in JPY, resulting in the sale ($3.1T at high velocity) of global assets (stocks, gold, crypto) to buy back Yen. This dynamic explains the negative correlation observed between USDJPY and these assets.

Mechanism:

USDJPY at 153.80 → High carry trade profitability but extreme exchange rate risk

↓ Fear of BoJ/MOF intervention to curb JPY weakness

↓ Early exit from JPY short positions

↓ JPY appreciation → Decreased carry trade profitability

↓ Forced deleveraging of JPY-funded positions

Sale of global assets (Stocks, Gold, Crypto) to buy JPY.

Quantitative data:

Estimated carry trade exposure: $11.5T (BIS)

High-velocity portion: $3.1T (potential to exit in <48h)

Critical USDJPY threshold: 155.00 (presumed intervention level)

Impact on correlations: Explains the negative correlation between USDJPY and other assets.

Analyse de marché

Analyse de marché