Share This Article

1. Executive Summary

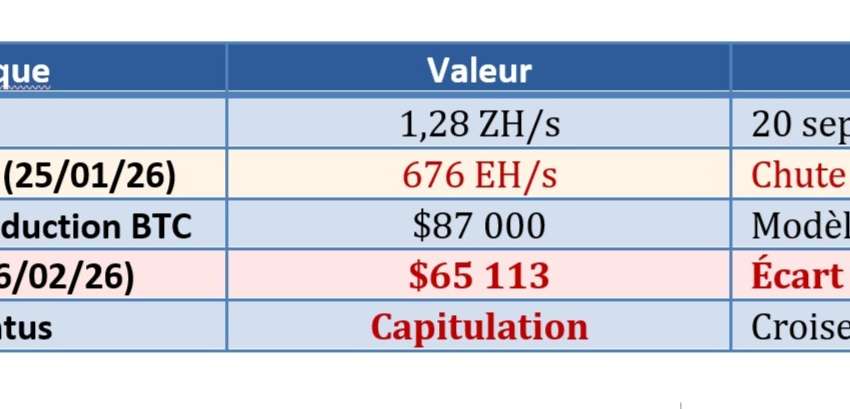

- Price: $103,500 (±1.3 %) – inside a 3-month, $101k-$110k bull-flag on 3-day closes.

- Structure: upward-sloping channel since Dec-2023; base ≈ $88k, top ≈ $120k.

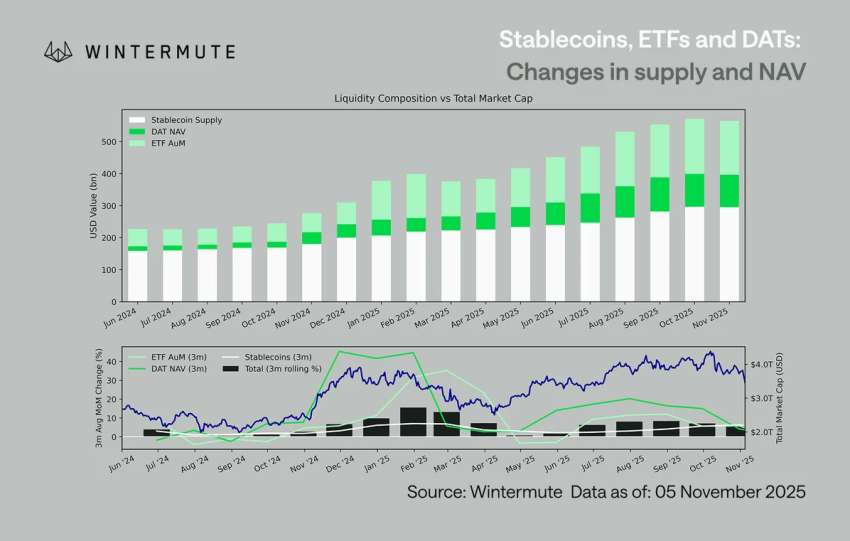

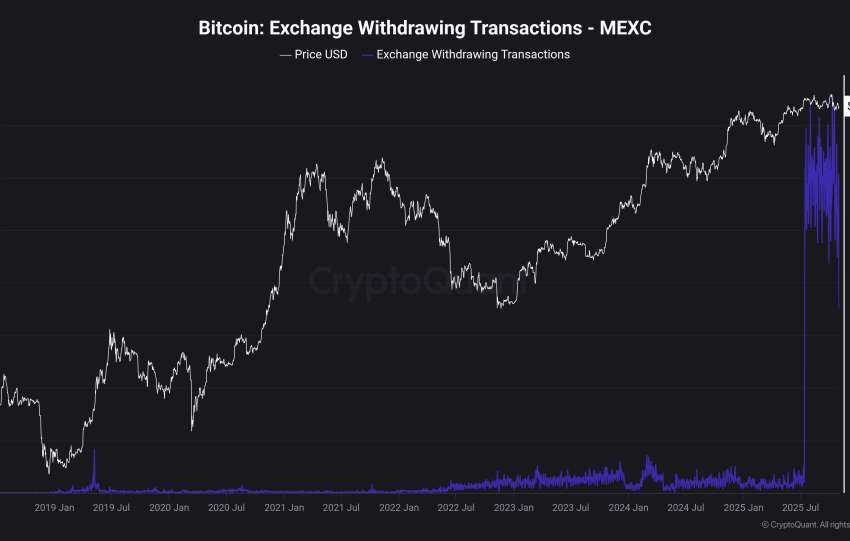

- ETF flows: 8-day net outflow (-12k BTC, -$1.3 B) but reserve on exchanges collapsed (-400k BTC, -12 %) → supply shock in progress.

- Seasonality: Q4-post-halving years → median +46 % (2012, 2016, 2020); current +29 % vs 1 Oct → target $xx5-xx0k by year-end fits historic range.

- Probability tree: x5 % break-out to $xx0-xx5k, 30 % range extension, 15 % channel failure $90k.

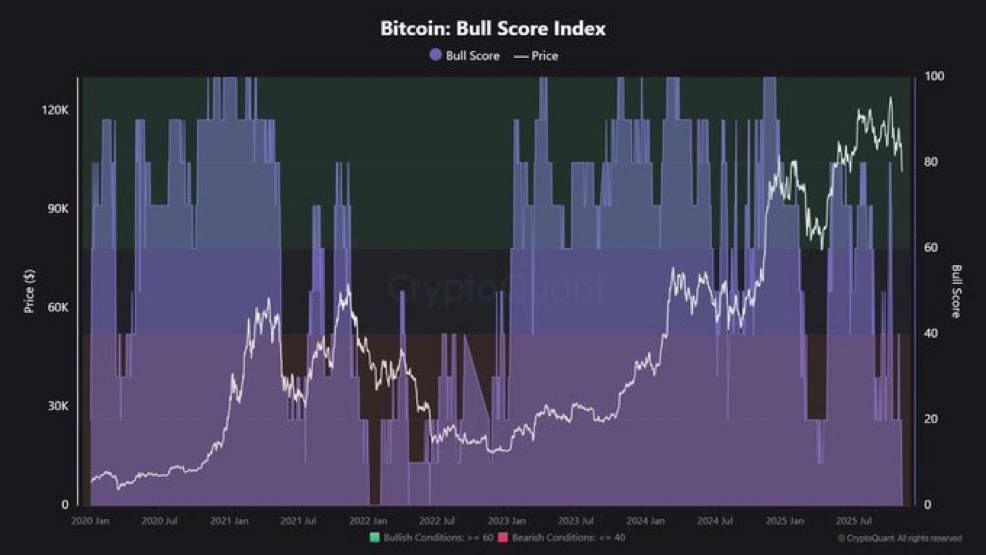

2. Chart Architecture (3-Day Close – Coinbase)

A. Channel Geometry

- Support line: joining Nov-2023 ($88k) – Apr-2025 ($95k) – Aug-2025 ($98k) → slope ≈ +$i50/week.

- Resistance line: Dec-2023 ($120k) – Mar-2025 ($118k) – Jul-2025 ($115k).

- Width: ~$20k → measured move on convincing close > $110k → $1i0-1i5k (Fib 1.618 extension).

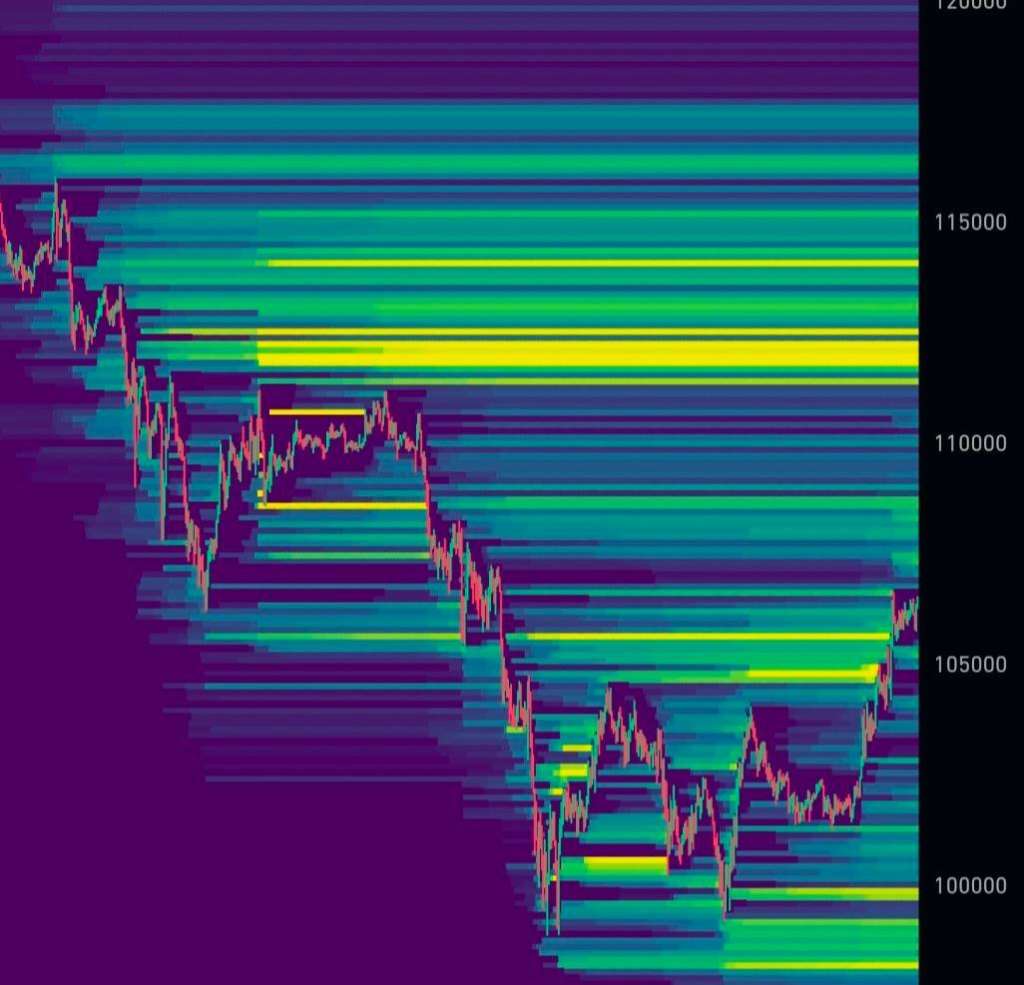

B. Volume & VWAP

- VPVR 12-month PoC: $67k (old accumulation) – current discount 35 % → […] re-accumulation zone.

- VWAP anchored at $42k (2024 low) stands at $92k → price > VWAP = macro bull intact.

C. Micro Pattern

- Inside-bar 3-day (107k-101k) after +1.3 % pop → coil before directional move.

- RSI 3-day: 58 → plenty of room vs over-bought (80).

- MACD: positive histogram, bullish cross since Aug-2025 → no divergence.

*ETFs are profit-taking into strength (classic post-halving behaviour) while real coins are moving to cold wallets faster than ETF outflows → net supply contraction > ETF selling.

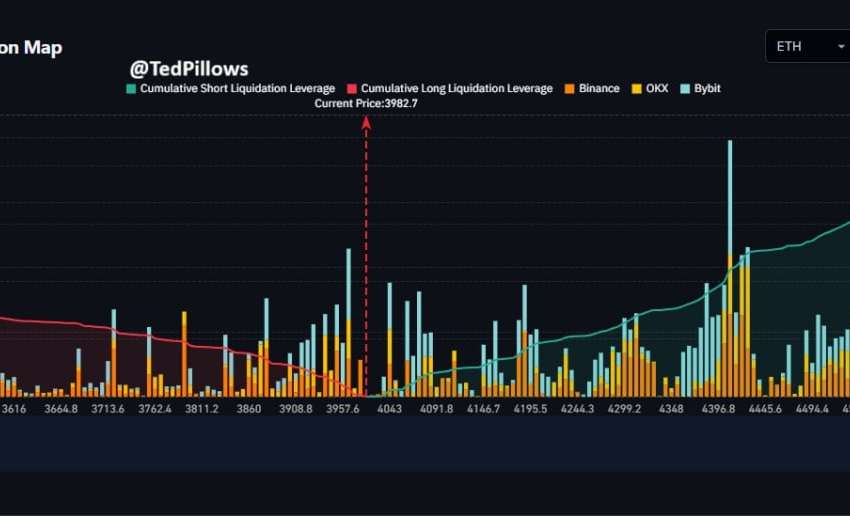

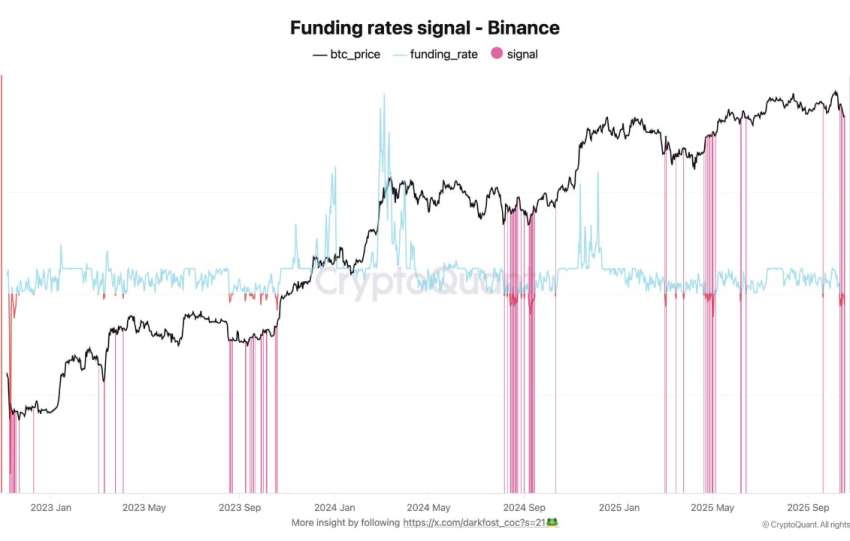

3. Derivatives – Positioning & Sentiment

- Funding rate BTC perpetual: avg. +0.015 % (8h) → slightly long-biased but not extreme.

- CME futures COT: Asset-managers net-long 1.35× (highest since May-2024) → institutional directional bet.

- 25-delta skew: call premium 3 % → moderate bullish demand.

- Open Interest: $22 B (vs $30 B peak Mar-2024) → room for levered long-add without cascade risk.

4. Macro & Liquidity Backdrop

- US 10-yr yield: 4.45 % (↓30 bps since Sep) → real-rates falling = tail-wind for zero-coupon assets.

- DXY: 102 (↓3 pts) → USD weakness supports USD-denominated crypto.

- Fed balance-sheet: flat since June → no QT acceleration; market discounts 2 cuts in 2026 → liquidity stable.

- Gold at ATH → monetary debasement trade → Bitcoin benefits from same narrative.

Steelldy Newsletter

Receive complete and useful Tax, Economic, and Financial studies by email for the management of your business.