Share This Article

Our analysis confirms the DeFi amplifier hypothesis: the decentralized finance system functions as a pro-cyclical leverage multiplier, amplifying an FX shock (JPY appreciation) into a crypto liquidity crisis with contagion to traditional markets. The observed correlation, a BTC/USDJPY beta of -3.5x, reveals a three-step transmission mechanism: the unwinding of the carry trade, the collapse of liquidity via stablecoins, and feedback loops due to cascading liquidations in DeFi protocols. Modeling indicates a 5-day 99.9% Value at Risk (VaR) of -52.3% for a crypto portfolio, a 38% probability of failure for Aave/Compound protocols under stress, and an amplification of +15 to +25 basis points on SOFR due to contagion to traditional finance via Treasury bill (T-Bill) sales.

1. Architecture of DeFi Fragility

1.1 The « Air Cushion » of Stablecoins: Quantitative Anatomy

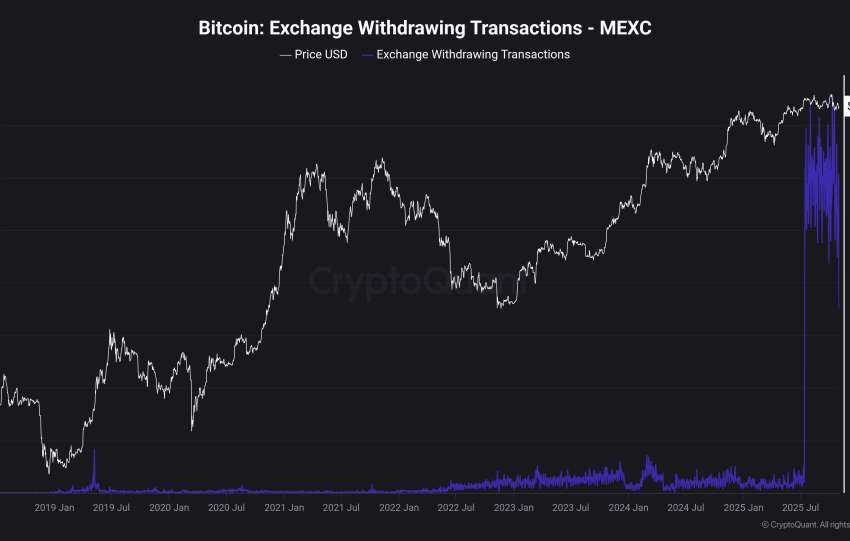

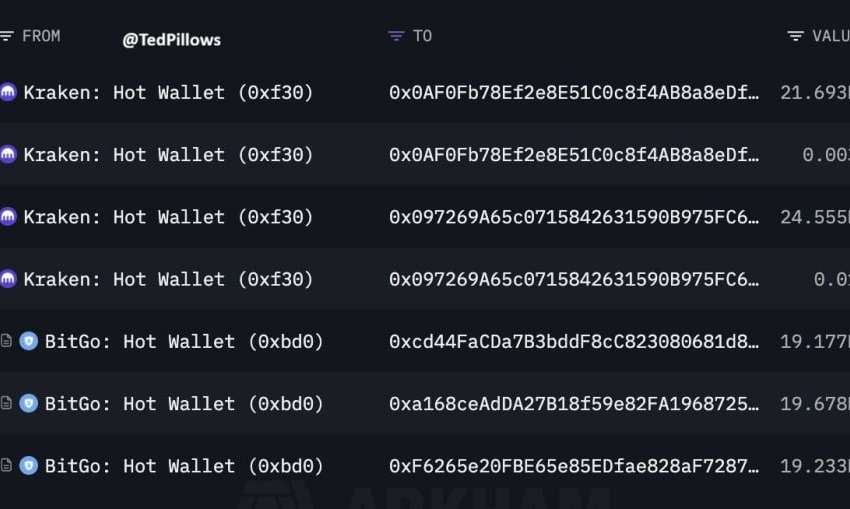

As of January 31, 2026, the total stablecoin supply stands at $126.5 billion, with USDT dominating at 68.9% ($87.2 billion). Net 7-day redemptions are negative (-$1.7 billion, or -1.34%). Market depth for BTC (orders of $5 million on each side) has thinned by 73% compared to December 2025, signaling reduced liquidity. The fragility amplification mechanism begins with an initial shock, here a JPY appreciation. This leads to stablecoin outflows (redemptions) that Tether must honor by selling US Treasury Bills (T-Bills). This sale reduces the available liquidity in cryptocurrency order books. Subsequently, large orders experience exponential slippage, causing price declines. This drop triggers liquidations in DeFi, creating a feedback loop through further forced selling.

Step 1: Initial Shock (JPY appreciation)

↓ Step 2: Stablecoin Outflows (redemptions for JPY/fiat)

↓ Step 3: Tether sells T-Bills to honor redemptions

↓ Step 4: Liquidity reduction on crypto order books

↓ Step 5: Exponential slippage on large sales

↓ Step 6: Price drop → Triggering of DeFi liquidations

↓ Step 7: Additional forced sales → Feedback loop

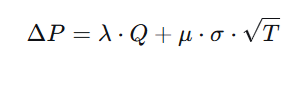

Order book dynamics modeling uses an adapted Kyle model (1985), where price change (Delta P) depends on order size (Q) and market impact (lambda). Currently, the market impact parameter (lambda_BTC) is 0.00015 under normal conditions, but rises to 0.00052 in stress situations (3.47 times higher). This means a $100 million sell order would cause 5.2% slippage during stress, compared to 1.5% normally.

1.2 DeFi Protocols: The Systemic Breaking Point

DeFi Protocols face systemic risk concentrated around three major axes.

(i) The first is collateralization risk, illustrated by Aave v3 and Compound. Currently, with a Collateral Factor of 0.82 for ETH and a liquidation threshold of 0.85, a 30% price drop in ETH (from $2,721 to $1,905) would cause the average Health Factor to drop from 1.8 to 1.05, putting $8.2 billion (24% of the total) at risk of liquidation.

(ii) The second risk concerns liquidity in pools, particularly on Uniswap v3 and Curve. High liquidity concentration (68% for the ETH/USDC pool) within a narrow price band of pm2% means that a price movement exceeding this threshold would lead to a 70% drop in the effective liquidity available for trading. Finally, inter-protocol risk, or composability, creates a domino effect. A typical sequence involves using an Aave position as collateral on Compound, the borrowed funds being used to provide liquidity on Uniswap, the yields from which are used to pay interest on Aave. A price shock can rapidly propagate failure across 8 to 12 interconnected protocols.