Share This Article

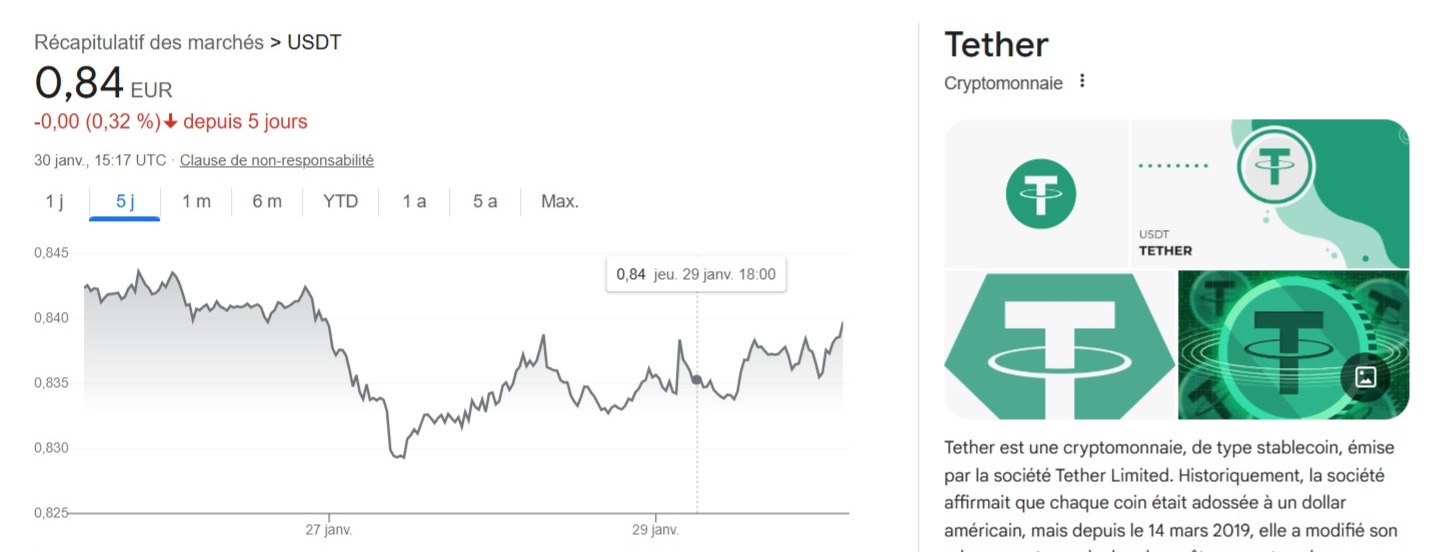

In our STEEL software, USDT is modeled as the first-tier systemic collateral in decentralized finance. A 10% contraction ($12 billion USD) is a negative convexity shock. Input variables include an initial USDT supply of $120 billion, a contraction speed at T+5 days (exogenous shock like a JPY Carry Trade unwind), an LIR < 0.22 (market makers unable to absorb selling pressure), and Open Interest on BTC Futures of $45 billion (average leverage 15x).

I. THE TRANSMISSION MECHANISM: FROM STABLECOIN TO SPOT PRICE

The contraction of USDT causes a « Forced Liquidation of Collateral. » Being the base pair for over 70% of BTC trading volume, its scarcity increases its opportunity cost (rise in USDT borrowing rates in DeFi). The Spot Selling Pressure (PVS) equation is defined by the change in USDT supply multiplied by a velocity factor and a non-linear slippage term. An estimated reduction of $12 billion in USDT is expected to lead to a direct drop in the spot price of -8% to -12% even before cascading liquidations, due to the evaporation of demand supporting the price.

II. SIMULATION OF LIQUIDATION CASCADES (THE DELEVERAGING ENGINE)

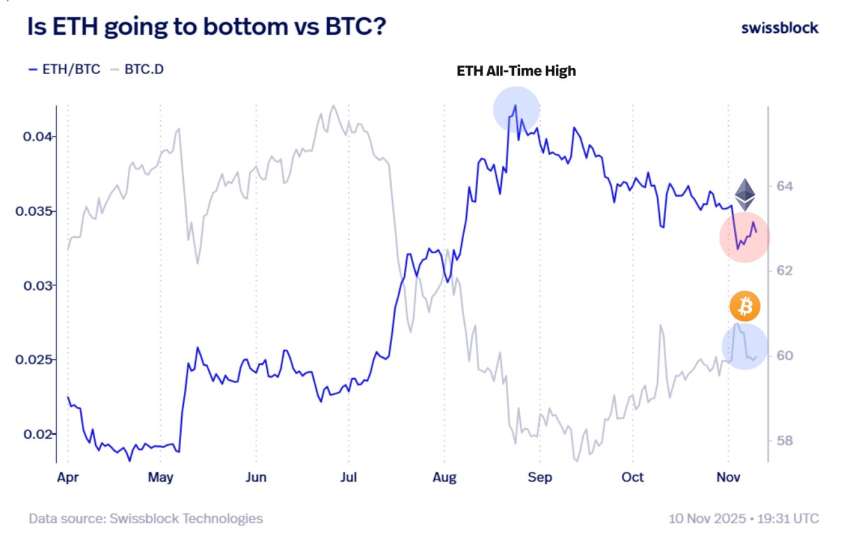

The simulation of cascading liquidations (the deleveraging engine) is accurate. The derivatives market primarily uses USDT as margin. Phase 1 begins with the breach of technical support at $78.5K, triggering the first stop-losses from directional funds. Phase 2 sees forced liquidations of long positions as the price drop hits margin ratios (20x and 10x). It is estimated that a 1% drop in price leads to the liquidation of approximately $1.5B in Open Interest (OI). This liquidation creates an avalanche effect: the forced selling of BTC by the exchange exacerbates the decline, triggering the next layer of liquidations. Finally, Phase 3 observes a « Funding Flip, » where the funding rate turns negative (below -0.08%), making it too costly to maintain long positions and forcing even experienced players to capitulate.

III. MONTE CARLO SIMULATION RESULTS (RISK CONTROL)

Monte Carlo simulation (10,000 iterations) on BTC (base $95,000): 60% of cases predict a price of $82,000 (-13.7%), 30% a price of $68,500 (-27.9%), and 10% a price of $54,000 (-43.2%).

Analysis of LGD (Loss Given Default): In the aggressive scenario, the SOPR (Spent Output Profit Ratio) falls below 1.0, indicating that even long-term holders begin to sell at a loss out of panic. Liquidity evaporates and the order book experiences a « Gap » where the price can drop by 5% in a few milliseconds.

A 10% contraction of USDT is the trigger for violent asset deflation. This is not a price adjustment, it is a balance sheet adjustment. The danger is not the drop in BTC, but the inability to exit because the « door » (the USDT supply) is narrowing exactly when everyone wants to borrow it.