Share This Article

The amplification mechanism relies on the scissors effect between accommodative US monetary policy (Fed rate cuts of -25 to -50 bps towards 2026) and a tightening by the Bank of Japan (+25 to +75 bps). This divergence, exacerbated by a 10x leverage for hedge funds, leads to a compression of the carry trade spread, making it deeply negative (-2.5% typical), and causes a sharp appreciation of the JPY.

The cascading dynamic starts with the weakening of the USD driven by Fed cuts, stimulating JPY appreciation.

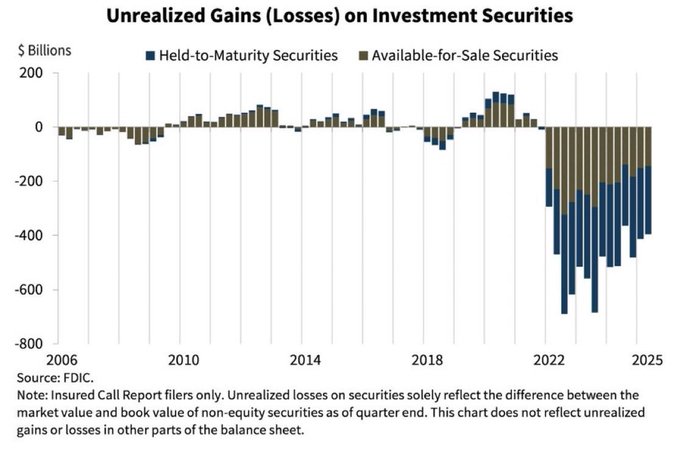

Simultaneously, BOJ hikes push up JGB yields, forcing a repatriation of Japanese capital and increasing pressure on the JPY. This double compression (spread and FX) generates margin calls on speculative funds (LTV > 85%), forcing a panic selling of assets (US Tech, UST, Crypto), leading to a global liquidity crisis.

Quantitative analysis shows that Fed cuts of -50 bps increase the probability of an accelerated « Unwind » to 68% and push the Value at Risk (VaR) from -$1.2T to -$2.02T USD. The timeline drastically shortens: the Unwind moves from 6-18 months to 2-4 weeks, with a stress peak in Q1 2026. The probability of a systemic crisis reaches 20%.

The impact on US Tech is amplified by this double FX/rate shock, potentially causing valuation depreciations of -25% to -55% for the most exposed sectors (AI).

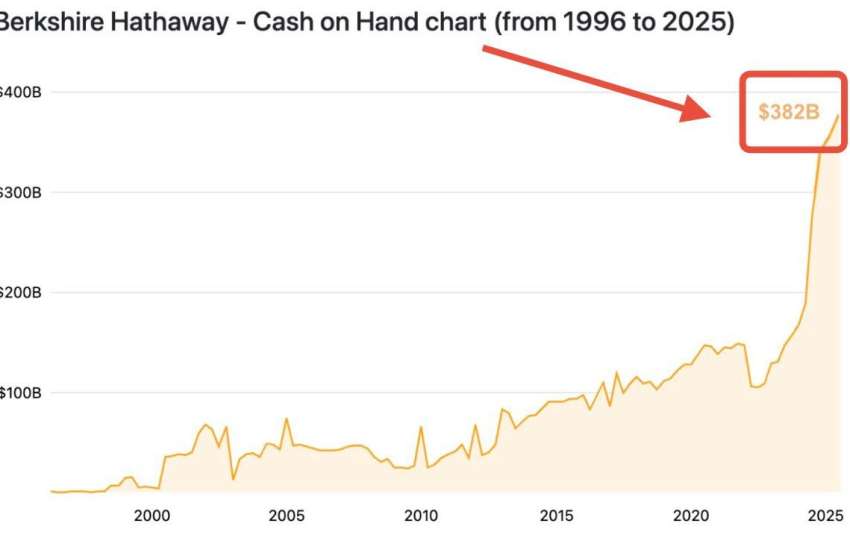

Critical monitoring indicators are lowered (e.g., USD/JPY below 148 triggers immediate de-risking). The strategic recommendation is to anticipate any dovish scenario from the Fed by immediately reducing risk, increasing liquidity to 25-30%, and strengthening collateral requirements. The Fed risks unintentionally accelerating the liquidity crisis it is trying to avoid.

Analyse de marché

Analyse de marché