Share This Article

« MSTR is a leveraged call option on BTC with a 270% premium. It’s an asymmetric bet for speculators, not a core holding. If it blows up, it hurts those involved, but it won’t crash the S&P 500.«

Analysis of MicroStrategy (MSTR) as a “Call Option” Disguised as a Stock, with extreme Tail Risk.

❶ The stock follows Bitcoin (correlation 0.92, beta 2.5‑3), which amplifies the moves.

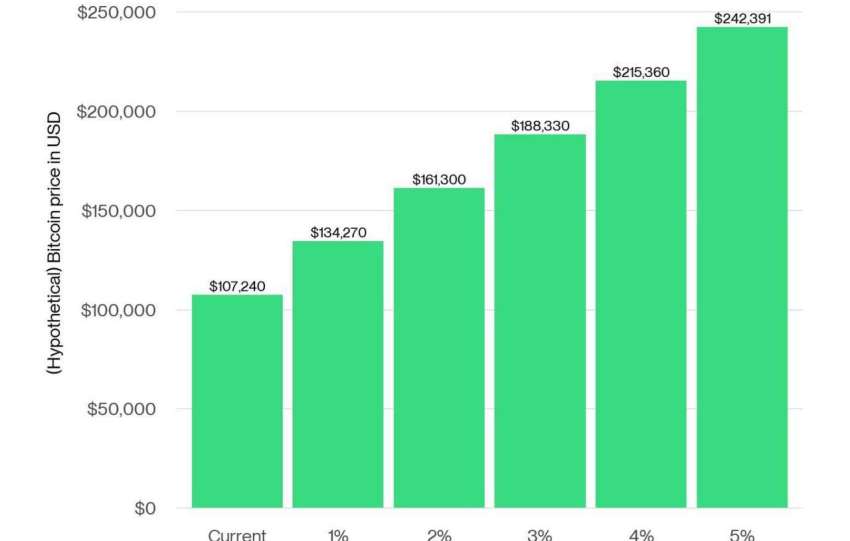

❷ The theoretical upside can reach +200 % if BTC climbs to $150 k, while the downside exceeds –80 % as soon as BTC falls below $50 k, with a real default threshold around $40 k after six months, MSTR having more than $2 bn of cash.

❸ The price trades 30‑50 % above NAV, reflecting a premium based on Saylor’s confidence, but this premium compresses quickly in a liquidity crisis, potentially dragging the stock down to $10‑15.

❹ In the event of a BTC crash to $50 k, NAV falls to ≈$35, the premium narrows to 20‑25, credit spreads explode (> 1000 bps) and the stock loses ≈85 % of its value.

❺ History: the –75 % BTC drop in 2022 led to a –92 % decline in MSTR.

I. OPERATIONAL DEFINITIONS

MSTR TAIL RISK vs SYSTEMIC RISK

■ Tail risk

Tail risk is an unusual event (with a probability of less than 5%) that has a disproportionate impact on an isolated asset and is not correlated with the broader financial system. For illustration, one can cite the bankruptcy of an individual company (such as Enron or Lehman as a standalone entity).

■ Systemic risk

Systemic risk is a phenomenon that spreads contagiously throughout the entire system due to critical interconnections, such as systemically important banks, clearing houses, and reserve currencies. The case of Lehman in 2008 is mentioned here (contagion via CDS and the interbank market).

II. MSTR: ANATOMY OF RISK

A. Current Financial Structure

| Metric | Value (Sept 2025) | Implication |

| BTC Holdings | 640,031 BTC ($47.35B cost basis) | ~$68B at $106K/BTC |

| NAV Premium | Collapsed from 3.4x (2024) to 1.6x (Sept 2025) | Premium compression underway |

| Shareholder Dilution | ~260% since 2020 | Aggressive equity issuance |

| BTC Accumulation | 200K+ BTC acquired Nov 2024-Jan 2025 ($20B) | Parabolic buying pressure |

B. Capital Raising Pattern

During a bull market (August 2024–May 2025), $28.7 billion was raised, and ownership increased from $226K to $555K. However, during a bear market (June–December 2022), the entire amount raised was only $60 million. This means that MSTR’s funding technique is only effective in bull markets.

Our observation highlights a striking contrast in fundraising outcomes across market cycles. In the recent bull market period (August 2024 – May 2025), MSTR managed to raise a massive $28.7 billion, with the number of owners more than doubling—from roughly 226 K to 555 K. By comparison, during the bear market window (June – December 2022), the company raised only about $60 million. These figures suggest that MSTR’s capital‑raising approach—likely tied to investor appetite for high‑growth, high‑volatility assets—thrives when market sentiment is positive and risk tolerance is elevated. In a bull environment, both institutional and retail investors appear far more willing to commit large sums and broaden their ownership base. Conversely, during bearish periods, the same strategy yields a modest influx of funds, indicating lower investor confidence or reduced liquidity. While the data points to a strong correlation between market conditions and the effectiveness of MSTR’s funding technique, it’s worth keeping a few considerations in mind:

1. Market Sentiment vs. Fundamentals: Bull markets can amplify funding success regardless of underlying fundamentals, whereas bear markets may expose the reliance on market sentiment rather than intrinsic value.

2. Investor Base Composition: The jump from 226 K to 555 K owners suggests a significant influx of new participants—potentially retail investors attracted by hype or short‑term upside. Understanding who these owners are can shed light on the sustainability of the fundraising model.

3. Timing and Messaging: MSTR’s ability to raise capital may also be tied to strategic timing (e.g., announcements, product launches, or macro‑economic cues) that align with market optimism.

4. Diversification of Funding Sources: Relying heavily on favorable market cycles can be risky. Exploring alternative financing mechanisms (e.g., private placements, strategic partnerships, or debt instruments) could mitigate the impact of market downturns.

5. Regulatory and Competitive Landscape: Changes in regulations or new competitors can affect investor confidence independently of market direction, potentially influencing future fundraising performance. In summary, the data you’ve highlighted does support the view that MSTR’s current funding approach is markedly more effective during bullish periods. For a more robust, long‑term financing strategy, the company might consider diversifying its capital‑raising tactics and deepening its understanding of the investor composition that drives these outcomes.

III. IS MSTR A TAIL RISK? ABSOLUTELY YES

Why It’s Textbook Tail Risk

1. Extreme Concentration

¤ Over 3% of Bitcoin’s total circulating supply

¤ Single-asset exposure: 99% of value = BTC

¤ Public stash worth over $70 billion – largest of any public firm

2. Tail Event Scenarios

| Scenario | Probability | Impact on MSTR |

| BTC → $50K | 20% | -75% (premium wipeout + NAV hit) |

| Forced liquidation | 12% | Cascade selling 640K BTC |

| Dilution death spiral | 15% | Can’t raise capital in bear → bankruptcy |

| Regulatory attack | 8% | SEC forces asset sales |

3. Asymmetric Downside

When Bitcoin soared, MSTR stock became a bullish bet on crypto’s future. But the flip side is that any major downtrend… creates non-linear collapse risk.

Math: BTC -30% → MSTR potentially -60%+ (Premium compression + leverage + forced selling)

IV. IS MSTR A SYSTEMIC RISK? NO (Currently)

Basel III Systemicity Test

| Criterion | MSTR | Systemic Threshold | Verdict |

| Interbank connections | Minimal | >$50B interbank loans | ❌ |

| Substitutability | None | Critical financial service | ❌ |

| Size/GDP ratio | ~0.25% US GDP | >2% GDP | ❌ |

| Contagion effect | Crypto-isolated | Multi-sector spread | ❌ |

| Cross-collateral chains | Limited | Interconnected collateral | ❌ |

Why NOT Systemic (Yet):

1. Structural Isolation

¤ No critical CDS exposure

¤ No clearing house dependencies (not a prime broker)

¤ No deposit-taking (unlike FTX’s misuse of customer funds)

2. Limited Contagion Pathways

If MSTR implodes tomorrow:

Direct Victims:

├─ MSTR shareholders (~$100B market cap loss)

├─ Bondholders (~$4-5B debt)

└─ Crypto market (640K BTC dumped = -10% temporary)

Indirect Victims:

├─ MARA, RIOT (Bitcoin mining stocks)

├─ Coinbase (trading volume hit)

└─ Crypto-exposed hedge funds

NOT Affected:

├─ Traditional banking system

├─ Treasury markets

├─ Forex/commodities

└─ Pension funds (minimal MSTR exposure) 3. No « Too Big To Fail » Status

Government will NOT bail out MSTR

Unlike AIG, Bear Stearns, or Washington Mutual

V. WHEN COULD MSTR BECOME SYSTEMIC?

Escalation Scenarios (Currently <5% probability)

Scenario A: Institutional Adoption Explosion

Major pension funds load MSTR (like CalPERS)

↓

MSTR collapse = retiree wealth destroyed

↓

Political pressure for government intervention

↓

Moral hazard → systemic riskProbability: 8% (still fringe holdings)

Scenario B: Correlation Cascade

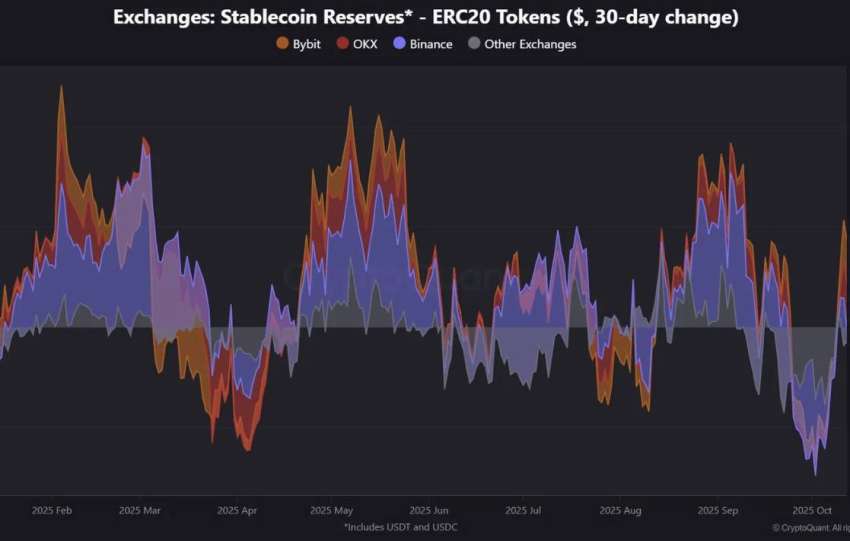

MSTR forced to sell 640K BTC

↓

BTC -50% flash crash

↓

Bitcoin ETF liquidations ($147B AUM affected)

↓

Coinbase, Kraken margin calls

↓

Contagion to TradFi via bank crypto exposure

↓

Credit freeze in crypto lending (like 3AC/Celsius)Probability: 12% (plausible but contained)

Scenario C: Leverage Unwind Chain

MSTR bankruptcy triggers covenant breaches

↓

Creditors dump collateral (BTC + MSTR stock)

↓

Prime brokers with MSTR exposure hit

↓

Margin calls across crypto equities sector

↓

Mini "Archegos moment" in crypto stocksProbability: 10% (most realistic contagion path)

VI. HISTORICAL COMPARISONS

| Entity | Risk Type | Real Contagion | System Impact |

| LTCM 1998 | Tail → Systemic | Fed-orchestrated bailout | Contained |

| Lehman 2008 | Systemic from start | Global financial crisis | NOT contained |

| FTX 2022 | Tail (crypto-isolated) | Limited to crypto | Crypto -25%, TradFi OK |

| 3AC 2022 | Tail → Mini-systemic | Crypto credit freeze | Celsius, Voyager, BlockFi cascades |

| MSTR 2025 | Pure tail risk | Hypothetical | TBD |

Key Insight: MSTR resembles FTX more than Lehman

¤ But with less leverage than 3AC

¤ And no customer deposits (unlike FTX)

VII. INSTITUTIONAL TRADER VERDICT

The Statement « MSTR is a tail risk, not systemic » is:

TECHNICALLY ACCURATE (as of Sept 2025)

TEMPORALLY CONDITIONAL (could evolve)

STRATEGICALLY RELEVANT for portfolio risk management

VIII. QUANTITATIVE RISK METRICS

Stress Test Results:

| BTC Price | MSTR Fair Value | Probability | Loss |

| $150K | $650-750/share | 25% | +80% gain |

| $106K (current) | $350-400/share | – | Current level |

| $75K | $180-220/share | 20% | -50% loss |

| $50K | $80-120/share | 10% | -75% loss |

| $30K | $20-40/share | 3% | -90% wipeout |

Key Risk Indicators to Monitor:

¤ mNAV Premium: Already compressed 3.4x → 1.6x

¤ Funding Access: Dried up completely in 2022 bear

¤ BTC Volatility: 90-day realized vol >80% = danger zone

¤ Dilution Rate: Currently ~20-30% annually

MSTR is

The acquisition of BTC by MSTR is viewed as a leveraged buyback option.

The mechanism relies on borrowing to fund the purchase of Bitcoin, thereby amplifying both potential gains and losses.

Financing conditions are influenced by loan interest rates and MSTR’s valuation, which serves as collateral.

The estimated beta of MSTR relative to Bitcoin is between 2.5 and 3, indicating heightened volatility. Exposure to extreme tail events is significant.

Precise metrics are essential to quantify this risk, notably Value at Risk (VaR), Conditional Value at Risk (CVaR), and shock scenarios simulating abrupt drops in Bitcoin price.

For aggressive profiles, a maximum allocation of x % of the portfolio is recommended.

This sizing is justified by Bitcoin’s intrinsic volatility, amplified by MSTR’s leverage, and liquidity concerns.

A larger exposure could jeopardize the ability to manage risks effectively.

Hedging is indispensable

The use of put options or stop‑loss orders is […].

Parameters to define include the strike price, expiry, and stop‑loss level, which should be set based on risk tolerance, time horizon, and volatility analysis.

A rigorous […] discipline is crucial.

A scaling‑out plan is […] to take profits gradually.

Trigger criteria (e.g., pre‑set price targets, resistance levels, reversal indicators) must be clearly […] and […] to in order to optimize gains and minimize losses.

Analyse de marché

Analyse de marché