Share This Article

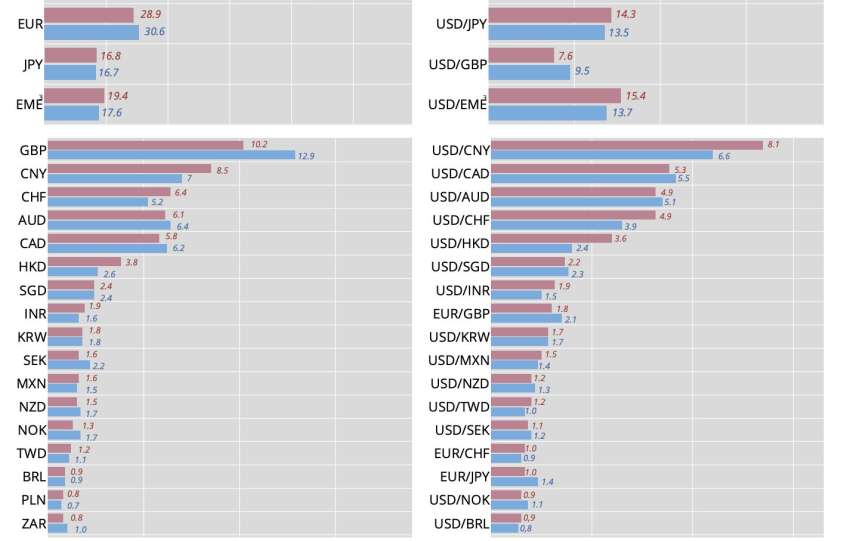

The Japanese yen-based carry trade, historically profitable (35-40% ROI with 10x leverage), is mathematically broken by the Bank of Japan’s (BOJ) rate normalization.

The current rate differential (4.25% US vs 1.00% JPY) drops to 3.25% before costs and yen appreciation. If the BOJ raises rates by more than an additional 50 basis points or if the yen appreciates by an additional 5%, the effective yield turns negative, due to high leverage (8-15x).

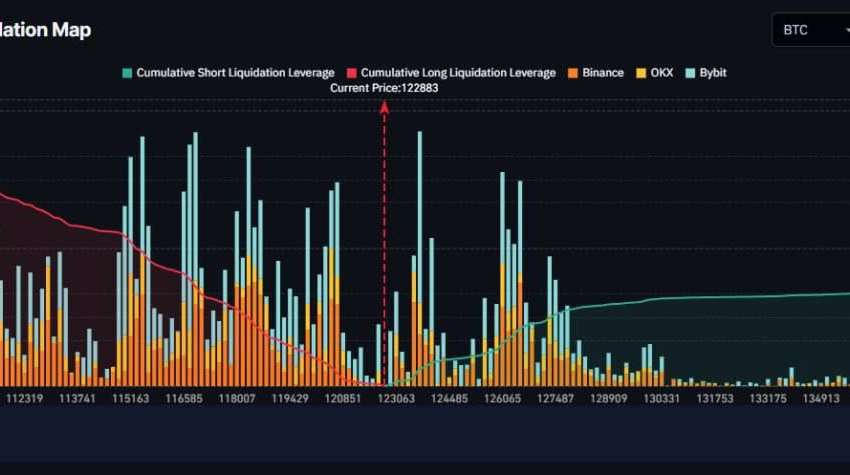

Total systemic exposure to the carry trade is estimated at $11.5 trillion. A shock to the yen triggers rapid margin calls: $3.1 trillion (Tier 1, Hedge Fund CTAs) could be liquidated in 2 to 5 days for a JPY movement exceeding +1.8%. Monte Carlo modeling projects an Expected Shortfall of $1.6 trillion and a 99% VaR of $2.4 trillion.

Contagion spreads through three main channels.

(a) The first is the US Treasury securities (UST) channel: a massive repatriation of Japanese capital would lead to the sale of $440 billion in USTs, causing a rise in 10-year UST yields of 40 to 50 basis points, directly impacting US mortgage rates (-18% in housing activity).

(b) The second channel involves US equities: forced liquidation of Hedge Fund positions could result in $102 billion in selling pressure on technology, causing a correction in tech indices of -8.7% to -11.3%.

(c) The third channel concerns global liquidity: stress in the repo market and increased margin calls in shadow banking signal a liquidity deficit estimated at $2.8 trillion and a high probability (78%) of fire sales affecting CLOs and leveraged loans.

Sources

Analyse de marché

Analyse de marché