Share This Article

[1] The note outlines a macro strategy linking (i) Gold, (ii) Bitcoin (BTC) and (iii) Capital Rotation.

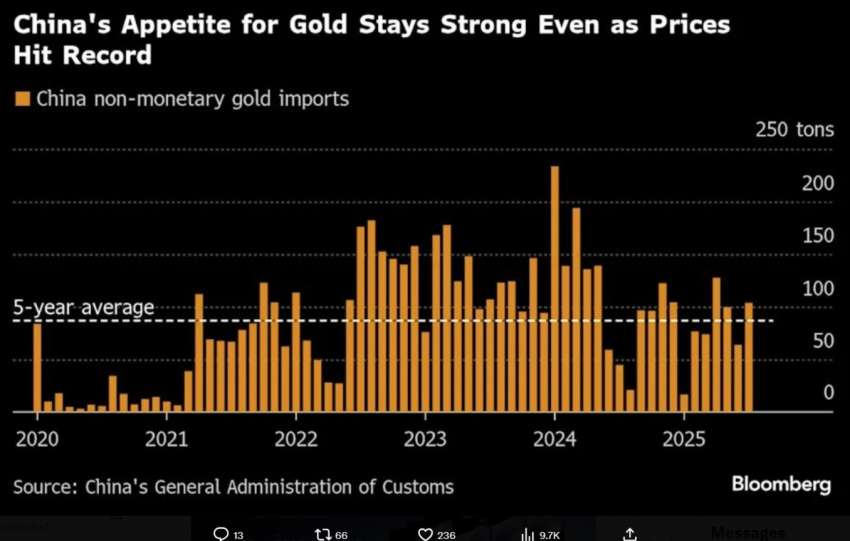

[2] Gold at $3,700 shows a loss of confidence in fiat, prompting a flight to tangible assets (+7% real return on commodities).

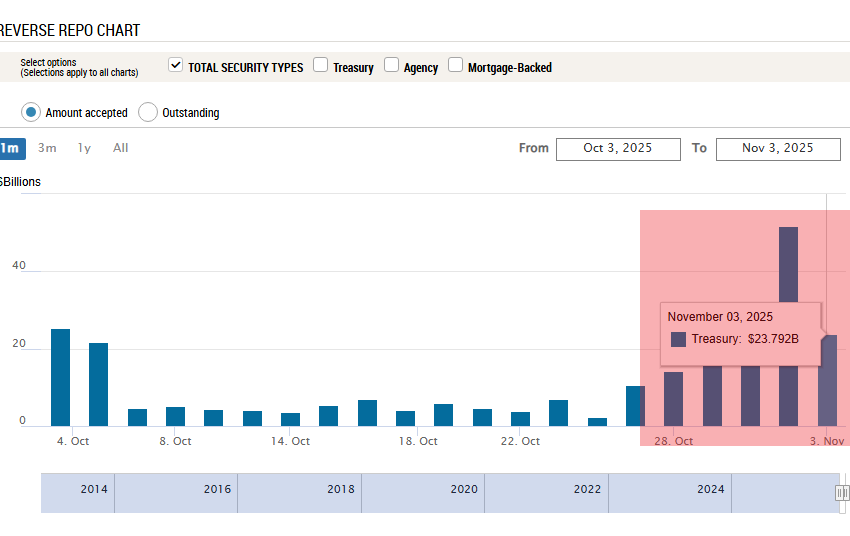

[3] BTC is “decoupling” temporarily: market makers break the correlation, create volatility and liquidate retail positions, while institutions quietly accumulate via ETFs and whales, reducing reserves on exchanges.

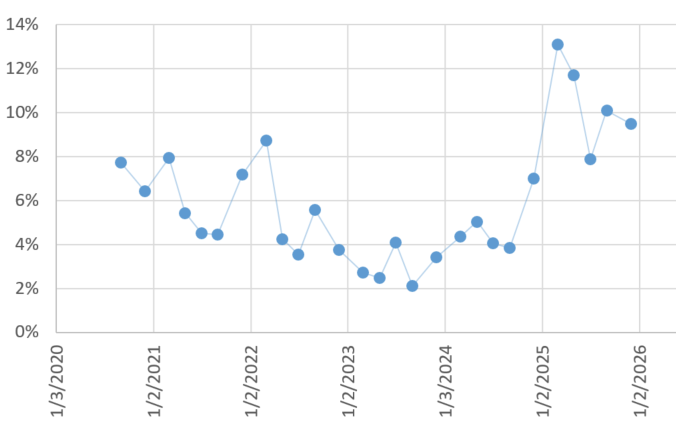

[4] This accumulation prepares an imminent rotation: BTC will catch up and then surpass Gold, as shown by +400% vs +67% (2022‑2024).

[5] The decoupling is a trap that allows buying BTC at a low price. When Gold stabilizes between $3,600 and $3,800, institutional allocators see BTC as a refuge with upside five times higher, triggering a massive influx into BTC ETFs.

[6] The target price forecast is $130,000‑$150,000, according to the historical ratio adjusted post‑halving.

[7] Recommendation: […] during the decoupling, follow gold (> $3,500) as an indicator, and prepare for a sudden and violent realignment.

Analyse de marché

Analyse de marché