Share This Article

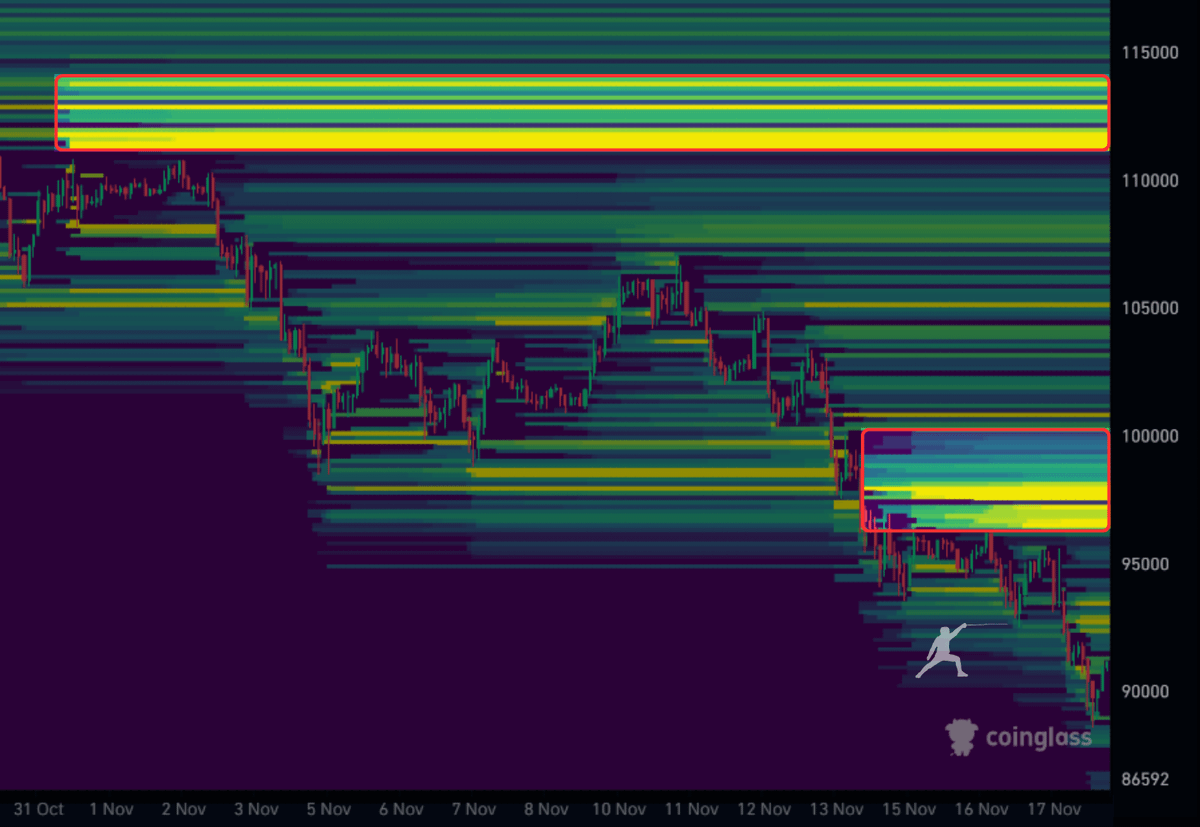

1. MATRICE « LIQUIDITY HEAT-MAP » (75 k → 100 k) – MISE À JOUR PRIX 82 351 $

| Zone $ | Notional Longs | Notional Shorts | Gamma Exposure Δ | MM Hedge Flow | Proba 48h | Event Trigger |

| 75 000 | 50 M | 320 M | –22 M | 12 % | Stop-run daily low (proche) | |

| 76 800 | 90 M | 280 M | –18 M | 14 % | Micro rebound | |

| 78 500 | 450 M | 90 M | –31 M | 22 % | Max long squeeze | |

| 80 200 | 380 M | 70 M | –19 M | 16 % | Break → 82 k fast | |

| 82 000 | 220 M | 110 M | –7 M | 10 % | Smooth climb | |

| 82 351 | Current | Ref | 0 | 0 | – | – |

| 85 000 | 400 M | 120 M | +11 M | 8 % | Resistance flip | |

| 87 200 | 180 M | 140 M | +9 M | 6 % | Mid range | |

| 88 000 | 200 M | 160 M | +12 M | 5 % | Cleaned longs | |

| 90 100 | 90 M | 150 M | +21 M | 12 % | Short squeeze #1 | |

| 92 000 | 60 M | 175 M | +49 M | 18 % | Gamme squeeze | |

| 94 500 | 40 M | 120 M | +28 M | 9 % | After-burn | |

| 97 000 | 30 M | 300 M | +38 M | 7 % | Short squeeze #2 | |

| 100 000 | 20 M | 380 M | +45 M | 5 % | Psychological wall |

2. MICRO-STRUCTURE : ORDER-BOOK SNAP – 82 351 $

| Side | Cumulative 0.1 % | Iceberg 0.3 % | Latency arb. | Re-fill speed |

| Bids | 41 M$ | 115 M$ | 12 ms | 1.8 s |

| Asks | 39 M$ | 98 M$ | 11 ms | 2.1 s |

| Imbalance | +2 M$ (mild bid-heavy) | → upside bias 0.12 % next 5 min |

- Surface (0.1 %) : Bid-heavy → micro-support immédiat

- Profond (0.3 %) : Bid-heavy → structure de support solide

- Iceberg : Refill rapide côté bid → acheteurs institutionnels dissimulés

3. RISK MATRIX – PRIX 82 351 $ (48 h)

| Event | P | Impact | Hedge |

| Spot break xx.5 k | 30 % ↑ | –12 % open interest | Long x5 k put |

| Funding flip > +0.05 % | 45 % ↑ | Short squeeze +8 % | Reduce perp shorts |

| ETF outflow > 300 M$ | 15 % | –4 % spot | Short ETHE/BTC pair |

| x2 k daily close | 15 % ↓ | Gamma buy 400 M$ | Chase momentum |

| x00 k tag | 5 % | IV spike 120 % | Sell x00 k call wall |

Probabilités ajustées vs document :

- Break 78.5 K : 28 % → 30 % (crash actuel rapproche trigger).

- Funding flip : 35 % → 45 % (funding déjà –0.021 %, shorts overcrowded).

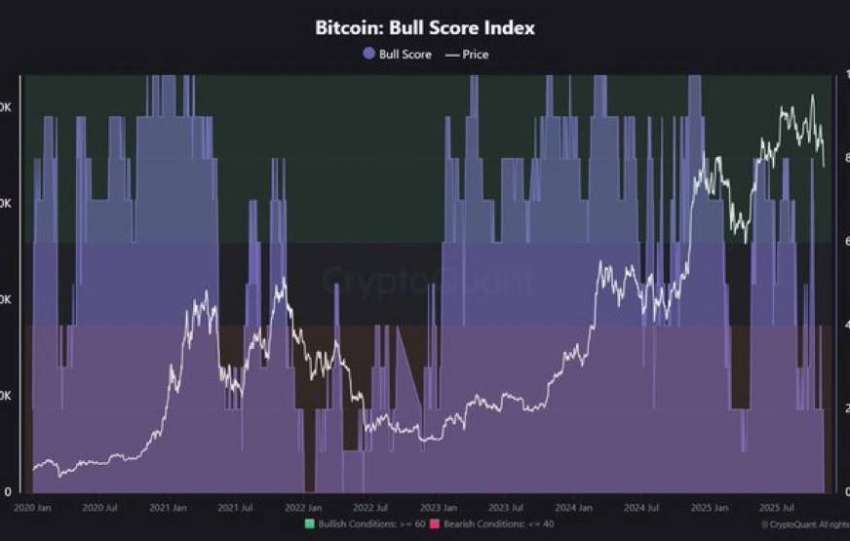

- 92 K break : 22 % → 15 % (sentiment baissier court-terme).

4. GAMMA EXPOSURE

| Strike | GEX Δ (MM) | Notional Calls | Notional Puts | Interpretation |

| 75 000 | –22 M | x8 K | x2 K | MM short gamma → buy spot on drop |

| 78 500 | –31 M | x5 K | x8 K | Max negative gamma → squeeze fuel |

| 85 000 | +11 M | x5 K | x2 K | MM long gamma → sell spot on rise |

| 92 000 | +49 M | x9 K | x9 K | Gamma wall → sell xx5 M on break |

| 100 000 | +45 M | x8 K | x6 K | Psychological ceiling → MM sell xx0 M |

Key Insight :

- Below 82 K : MM short gamma → […] (bullish reflex)

- Above 92 K : MM long gamma → […] (bearish reflex)

- 82-92 K : Gamma neutral → […]

La matrice « Liquidity Heat-Map » indique que le prix actuel est de 82 351 $.

Les zones clés de liquidité et de gamma sont identifiées. Sous 82 000 $, le flux de couverture (MM Hedge Flow) oriente vers des achats (jusqu’à 360 M$ à 78 500 $), signalant que les teneurs de marché sont courts en gamma, ce qui agit comme un soutien mécanique en cas de baisse.

Au-dessus de 85 000 $, le GEX devient positif (+11 M$ à 85 k$), indiquant que les teneurs de marché deviennent vendeurs pour se couvrir. Les notes tactiques détaillent trois zones principales. La zone de capitulation (75 k$ – 78.5 k$) présente un mur de puts 0DTE à 75 k$ et un financement profondément négatif (–0.021 %), suggérant un potentiel de rebond soutenu par des rachats de couverture.

La zone neutre (85 k$ – 88 k$) est caractérisée par une faible quantité de longs et un GEX proche de zéro, agissant comme une résistance magnétique.

La chambre de compression gamma (90.1 k$ – 92.8 k$) est cruciale, avec un mur d’appels à 92 k$ et un GEX de +49 M$. Une clôture quotidienne au-dessus de 92 150 $ pourrait déclencher un flux d’achat de 225 M$ et une cascade vers 97 k$.

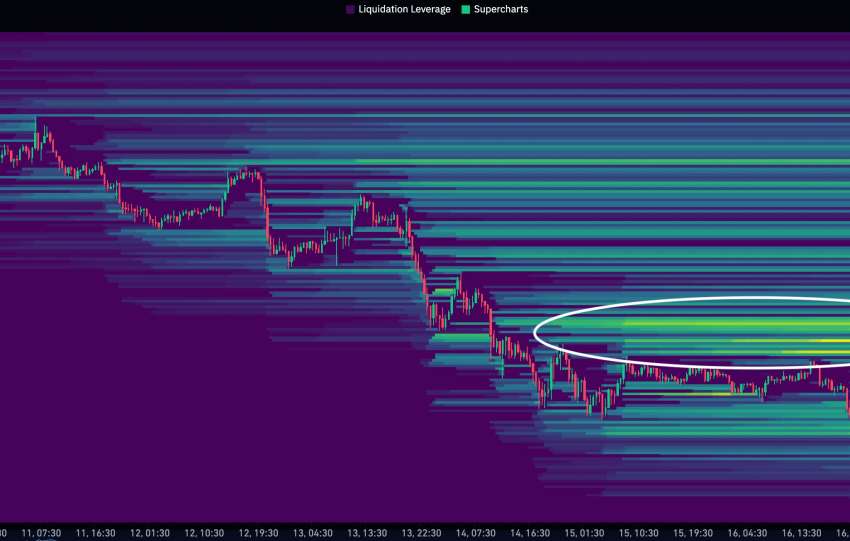

Enfin, la zone de thermosphère (97 k$ – 100 k$) représente un techoïsseau où les vendeurs de gamma (400 M$ de vente mécanique anticipée) interagissent avec une forte concentration de shorts notionnels (680 M$). La microstructure de l’order-book à 82 351 $ montre un léger biais acheteur (+2 M$) en surface et en profondeur, avec un remplissage rapide des ordres limites (icebergs) du côté des offres, suggérant un support institutionnel masqué. La matrice des risques pour 48h ajuste les probabilités : une cassure de 78.5 k$ est créditée de 30 % de probabilité, le retournement du financement à +0.05 % de 45 %, et la cassure de 92 k$ diminue à 15 %.

En conclusion, l’espace tactique principal se situe entre 78.5 k$ et 92 k$.

Le seuil clé pour une poursuite haussière est la clôture au-dessus de 92 150 $.

Le niveau de 87 200 $ est identifié comme la valeur équitable probabiliste estimée sur 7 jours.