Share This Article

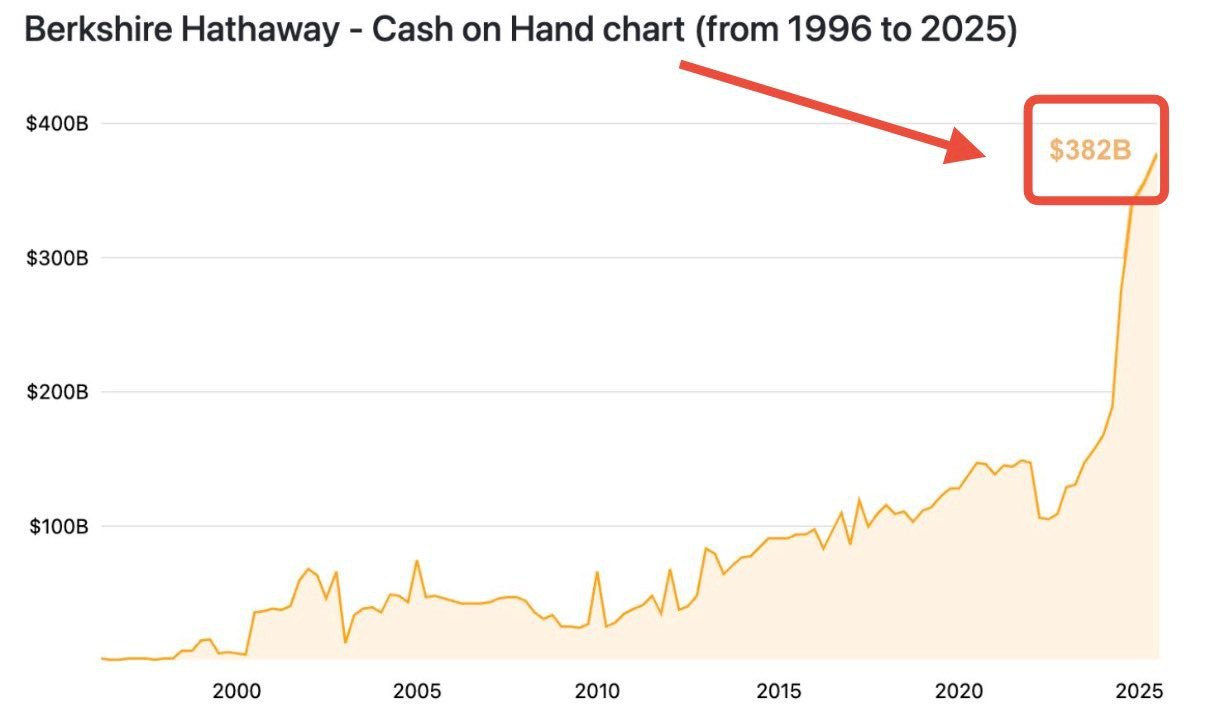

1. CASH POSITION ANALYSIS

Current Cash: $189B

% of Assets: 18% (vs 10% normal, 15.5% avg pré-crise)

Signal Strength: +16% above historical pre-crisis average

Historical Context:

├─ 2007 Pre-Crisis: $44B (15%) → 8 months to crisis, SPX -57%

├─ 2019 Q4 Pre-COVID: $128B (16%) → 4 months to crisis, SPX -34%

└─ 2025 Current: $189B (18%) → ??? months to crisis, SPX -??%

Interpretation: Extreme Warning « Highest defensive cash position in Buffett’s 60-year history »

2. SECTOR ROTATION ANALYSIS

Major Changes (2022-2025):

├─ Financials: -35% (EXIT regional banks, reduce BAC)

├─ Technology: -15% (Trim Apple despite being largest holding)

├─ Energy: +18% (Inflation hedge)

├─ Utilities: +8% (Defensive)

└─ Cash: +85% (DRY POWDER accumulation)

Pattern: Classic pre-crisis rotation Cyclicals/Growth → Defensives + Cash Historical Analogue: 2007-2008 Buffett made similar rotation 6-12M before financial crisis

3. IMPLIED MARKET VIEW

Excess Cash: $84B (beyond normal 10%).

Opportunity Cost: $4.2B/year forgone Implied

Expected Decline: ~35-40%

Timeline: 6-18 months

Interpretation: Buffett is willing to forgo $4.2B annual returns to maintain dry powder. This implies he expects significant market dislocation offering 15%+ IRR opportunities within 12-18 months.

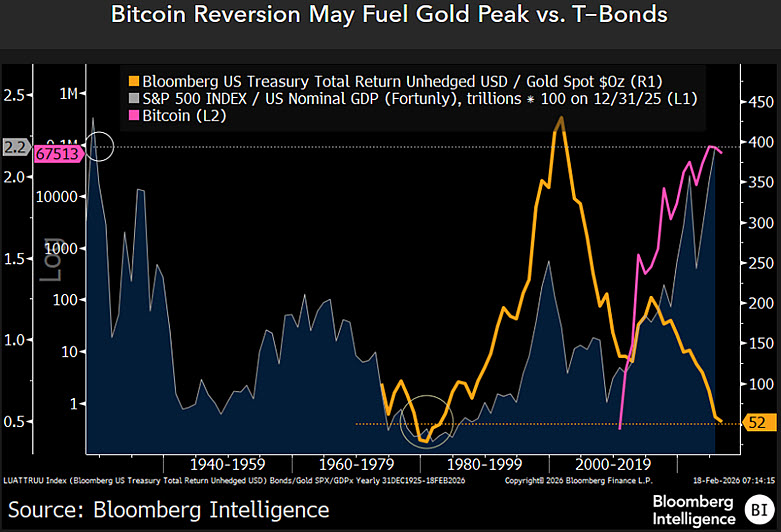

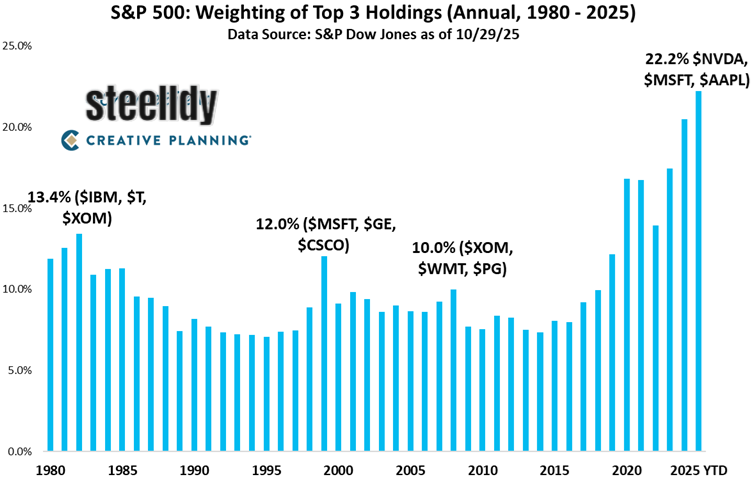

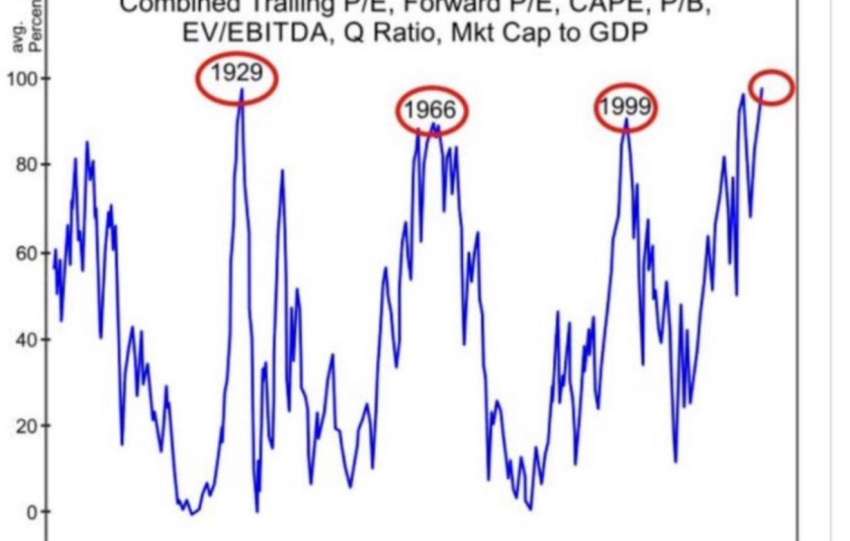

4. BUFFETT INDICATOR

Current Reading: 1.85 (Market Cap / GDP)

Long-Term Average: 0.85

Deviation: +118% above mean Implied

Overvaluation: 54%

Historical Context:

├─ 2000 Dot-com Peak: 1.40

├─ 2021 Bubble Peak: 2.05

├─ 2025 Current: 1.85 (still in bubble territory)

└─ Fair Value: 0.85 (implies 54% overvaluation)

Signal: Extreme Overvaluation

Market would need to decline ~54% to reach historical mean.

Warren Buffett is positioning for a Major market dislocation:

Evidence:

✓ Record $189B cash (18% of assets)

✓ Aggressive selling of financials (-35%)

✓ Reduction of tech exposure (-15%)

✓ Rotation to defensives (energy, utilities, staples)

✓ Buffett Indicator at 1.85 (extreme overvaluation)

✓ Pattern matches 2007 pre-crisis positioning Implied View:

– Market overvalued by 35-50%

– Crisis probable within 6-18 months

– Sectors at risk: Financials, Tech, Cyclicals

– Opportunity:

¤ deploy $84B+ at crisis lows

Historical Accuracy

2007: Positioned defensively → Deployed aggressively 2008-2009

2019: High cash → COVID crash → Massive buying opportunity

2025: highest cash ever → Expecting largest opportunity?

When the greatest investor in history raises cash to record levels, exits financials aggressively, and foregoes billions in returns, prudent investors should pay attention.

Analyse de marché

Analyse de marché