SYNTHÈSE EXÉCUTIVE : LA MORT DU PARADIGME BULLE/NON-BULLE

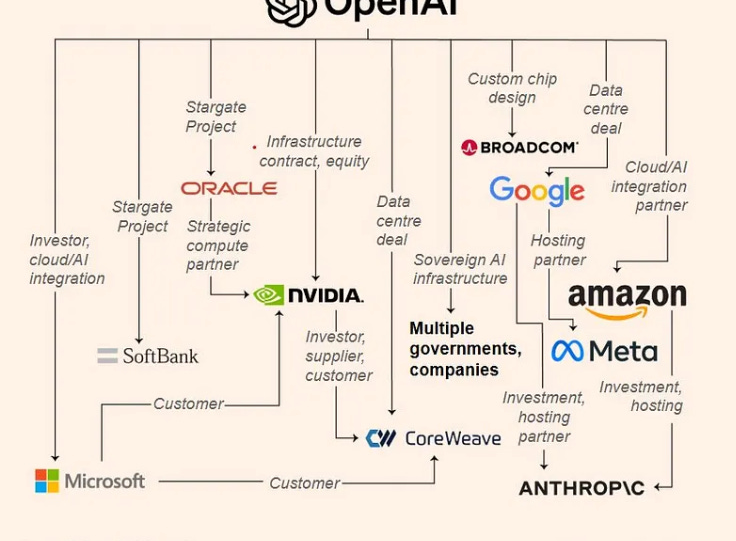

L'annonce d'OpenAI d'investissements massifs ($1.4T/30GW d'ici fin 2025) a définitivement anéanti le débat bulle/non-bulle, instaurant un régime d'interdépendance critique. Ce "Sam's Spending" est un point d'inflexion structurel majeur. Le changement de paradigme est noté très haut, avec une forte probabilité de permanence.

Trois méta-transformations sont observées…

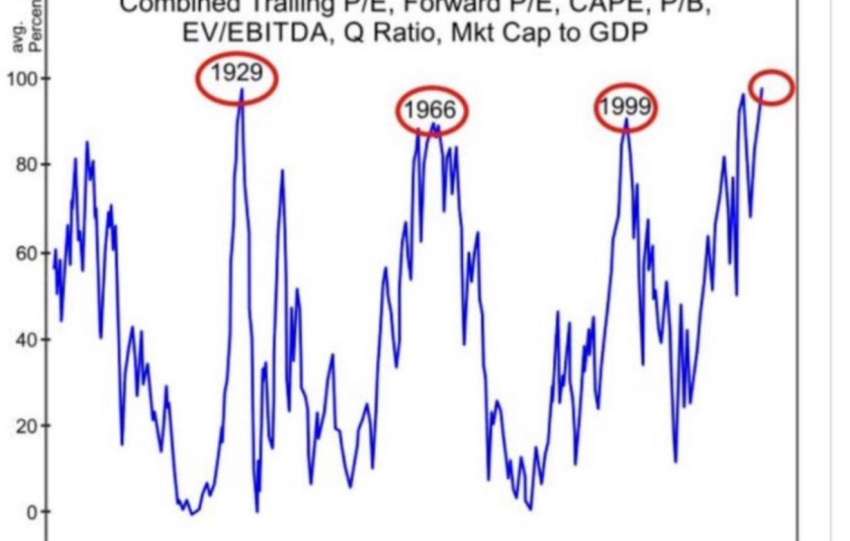

Analyse de marché

Analyse de marché