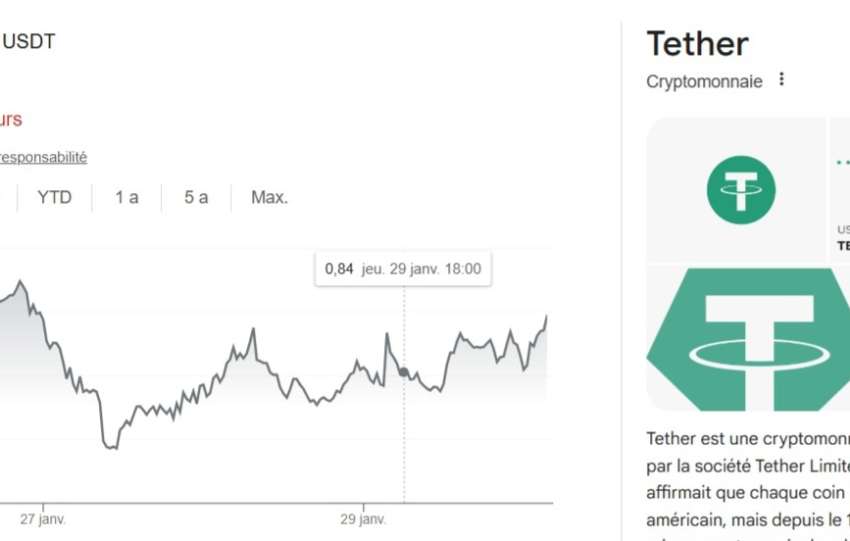

In our STEEL software, USDT is modeled as the first-tier systemic collateral in decentralized finance. A 10% contraction ($12 billion USD) is a negative convexity shock. Input variables include an initial USDT supply of $120 billion, a contraction speed at T+5 days (exogenous shock like a JPY Carry Trade unwind), an LIR < 0.22 (market…