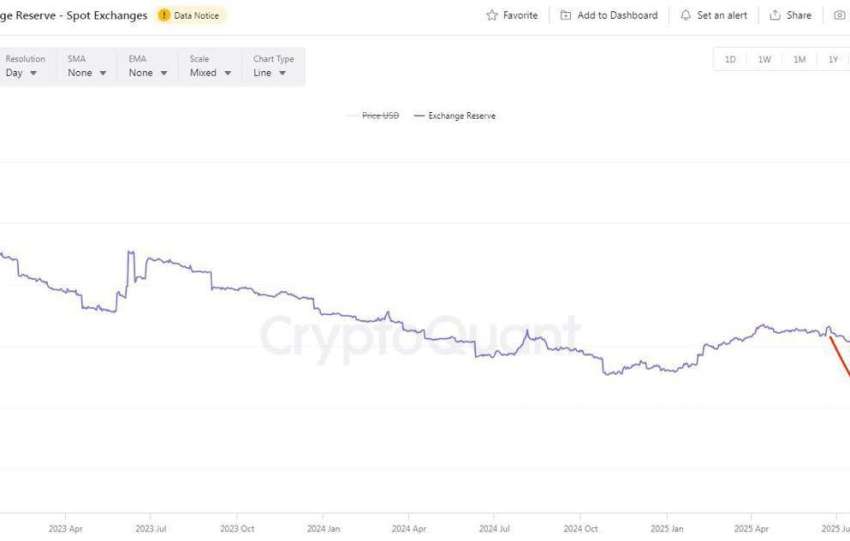

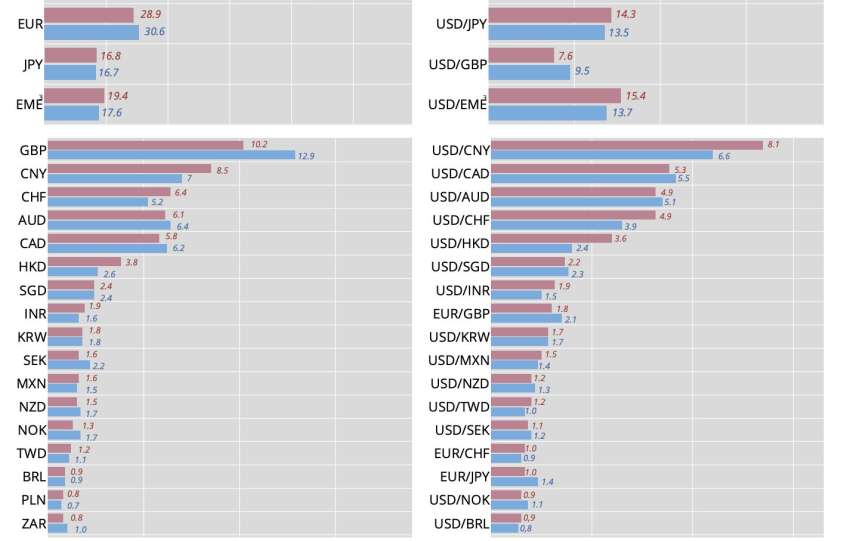

This analysis causally links macro-geopolitics (de-dollarization) to micro-speculation (AI bubble) and our investment thesis (Fed Pivot). The analysis of the text and image (de-dollarization) confirms that the financial environment is not stable, but its fragility is the driver of our opportunity.

MACRO & FINANCIAL ANALYSIS: DEDOLLARIZATION, DRIVER OF THE AI PIVOT AND BUBBLE

…

Analyse de marché

Analyse de marché